YTC Ventures | TECHNOCRAT MAGAZINE | www.ytcventures.com

11 Jan 2026

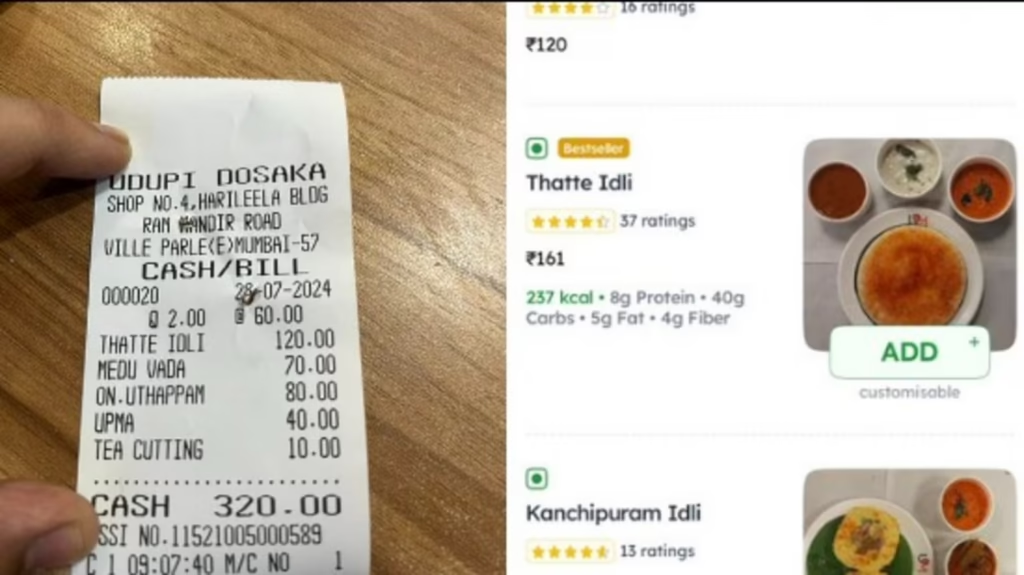

In the fast-growing food delivery market of India’s top cities — Delhi-NCR, Mumbai, Bengaluru, Hyderabad, and Kolkata — convenience often comes with hidden costs that spark widespread frustration. A recent viral complaint by former YouTuber Nalini Unagar (@NalinisKitchen on X, YouTube: @nalinis.kitchen) has once again put the spotlight on pricing transparency issues faced by millions of users on platforms like Zomato and Swiggy.Nalini, known for her cooking content on Nalini’s Kitchen (YouTube handle:@nalinis.kitchen), shared that an order she checked directly with a Bengaluru restaurant came to ₹320, but the same items appeared as ₹655 on Zomato before any discounts — eventually settling at ₹550 after applying coupons. She called the difference “absolutely insane” and accused the platform of blatant overcharging in a post that exploded in popularity.

Here are the viral screenshots she shared, showing the stark price comparison:

Her explosive X post (@NalinisKitchen) — which garnered over 8,400 likes, 1,495 reposts, 215 quotes, 1,892 replies, and 1.5 million+ views in just a day — read:

“Dear @zomato, the actual price of my order is ₹320, but on Zomato it’s ₹655. Even after applying discounts, I still have to pay ₹550. This price difference is absolutely insane. Customers are being blatantly overcharged.

”This massive engagement turned her complaint into one of the most talked-about consumer stories of the week, flooding timelines with similar experiences and debates.This is not a one-off incident. It reveals deeper structural tensions in how the entire food delivery ecosystem makes money.

The Viral Complaint That Sparked the Debate

Nalini (@NalinisKitchen) posted clear side-by-side screenshots:

- Restaurant direct price: ₹320

- Zomato displayed price (pre-discount): ₹655

- Final amount after discount: ₹550

The platform’s response was that restaurants themselves decide the menu prices shown on the app, which can be different from in-store prices to cover commissions, packaging, and other operational costs.

Many users argue this explanation lacks upfront transparency — customers often discover the difference only after comparing.

How Widespread Are These Complaints?

Similar stories appear regularly across social media.

Users frequently report:

- Menu items priced 1.5× to 2.5× higher on apps compared to the restaurant menu

- Surprise platform fees, packaging charges, and delivery surge pricing

- Delivery distance inflated to justify higher fees

- Priority listing and advertising fees indirectly passed on to customers through price hikes

These complaints tend to spike during festivals, weekends, and rainy seasons when demand surges and extra fees kick in.

The pattern has persisted for several years, with hundreds of public posts and forum discussions surfacing annually.

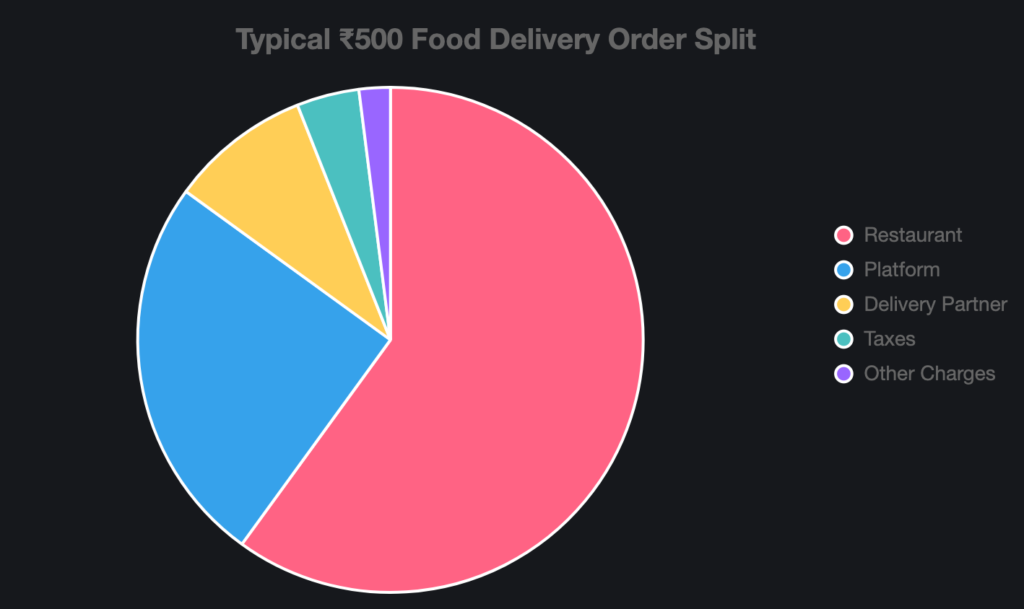

Breaking Down a Typical ₹500 Order in a Top City

Here’s how the money is typically distributed in an average food delivery order of ₹500 (based on industry patterns in 2025–2026):

- Restaurant receives: 43–75% (₹215–₹375)

Restaurants get the largest share but often increase app prices to compensate for high commissions. - Platform (Zomato/Swiggy) takes: 20–30% commission + platform fee + advertising cut (total ~₹100–₹225)

This funds technology, marketing, discounts, and operations. - Delivery partner earns: 8–10% (₹40–₹50)

Gig workers receive per-order pay, though many feel the amount is shrinking. - Government (GST & taxes): 3–5% (₹15–₹25)

- Other charges (packaging, surge, handling): ₹20–₹100+ (often added directly to the customer)

Visual Breakdown of a ₹500 Order:

This split explains why restaurants frequently raise prices on apps — to protect their margins after platforms deduct hefty commissions.

How Profitable Is Food Delivery Really?

After years of heavy losses and customer subsidies, the sector has started turning profitable — but margins remain very thin.Zomato’s food delivery business achieved around 5–7% profit margin on net order value in recent quarters — one of its strongest performances yet.

The company now earns meaningful quarterly profit from food delivery alone, while quick commerce (like Blinkit) is growing even faster and contributing significantly to overall earnings.Swiggy follows a similar trajectory but still lags slightly behind in profitability.

Overall, the industry operates on 5–7% net margins after covering massive fixed costs in technology, customer acquisition, and delivery fleet management.

The Bigger Picture

The food delivery duopoly (Zomato and Swiggy controlling over 90% of the market) gives platforms strong pricing power, but it also attracts regulatory attention. Consumers demand greater transparency — clear disclosure of markups, mandatory display of restaurant-set vs platform-adjusted prices, and fair treatment of delivery partners.Until then, viral complaints like Nalini Unagar’s (@NalinisKitchen on X, former YouTube:@nalinis.kitchen) will continue to highlight the gap between the promise of convenience and the reality of hidden costs.

Technocrat Magazine has amplified Nalini Unagar’s original viral post (@NalinisKitchen) on X alongside this analysis to keep the conversation going.

#FoodTech #Zomato #Swiggy #Overcharging #IndiaEats

What do you think — is the price difference fair for the convenience, or does the industry need stronger transparency rules?

Drop your thoughts below.

Comments