A 12-day conflict between Israel, Iran, and the United States in June 2025, marked by Israeli strikes on Iranian nuclear facilities and U.S. military intervention, ended with a fragile ceasefire on June 24. The brief but intense war, which killed at least 950 Iranians, including 71 in an Israeli strike on Tehran’s Evin Prison, has left the Middle East on edge. As global powers like China and Russia advocate for de-escalation, questions remain about the ceasefire’s durability and the region’s future.

Current Status: A Fragile Ceasefire

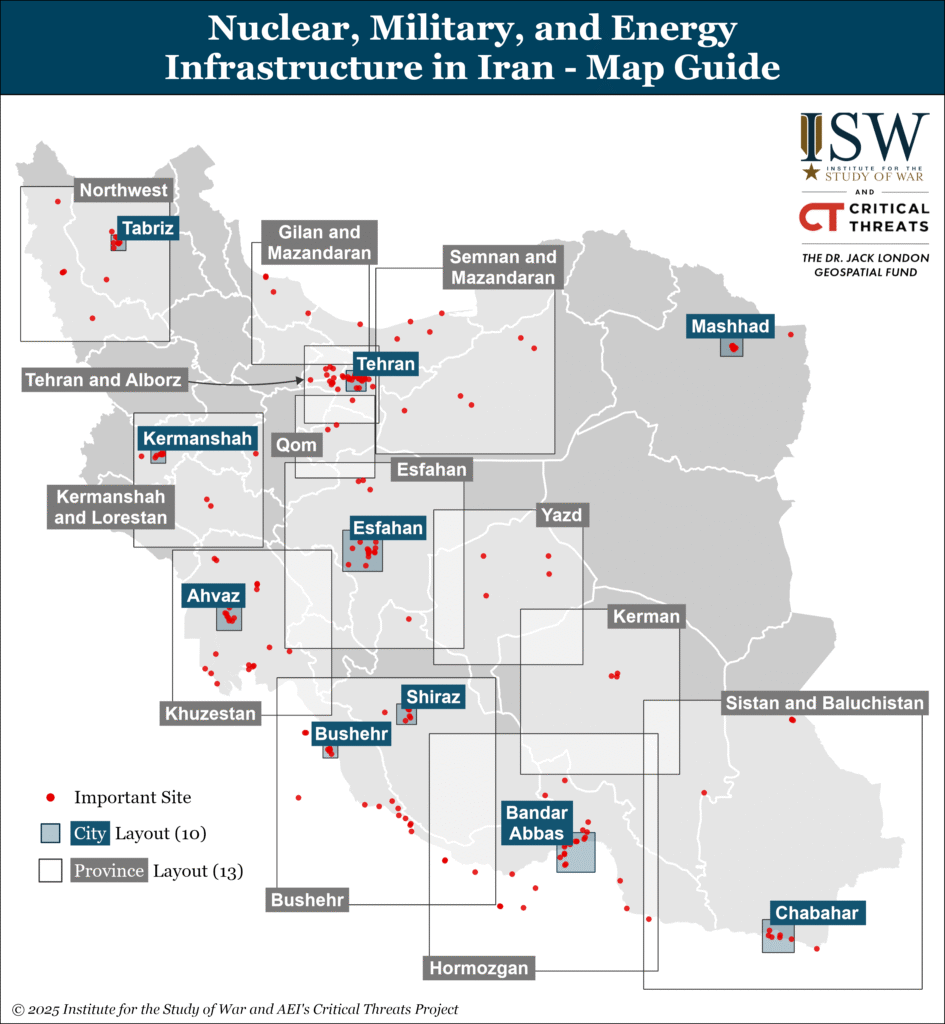

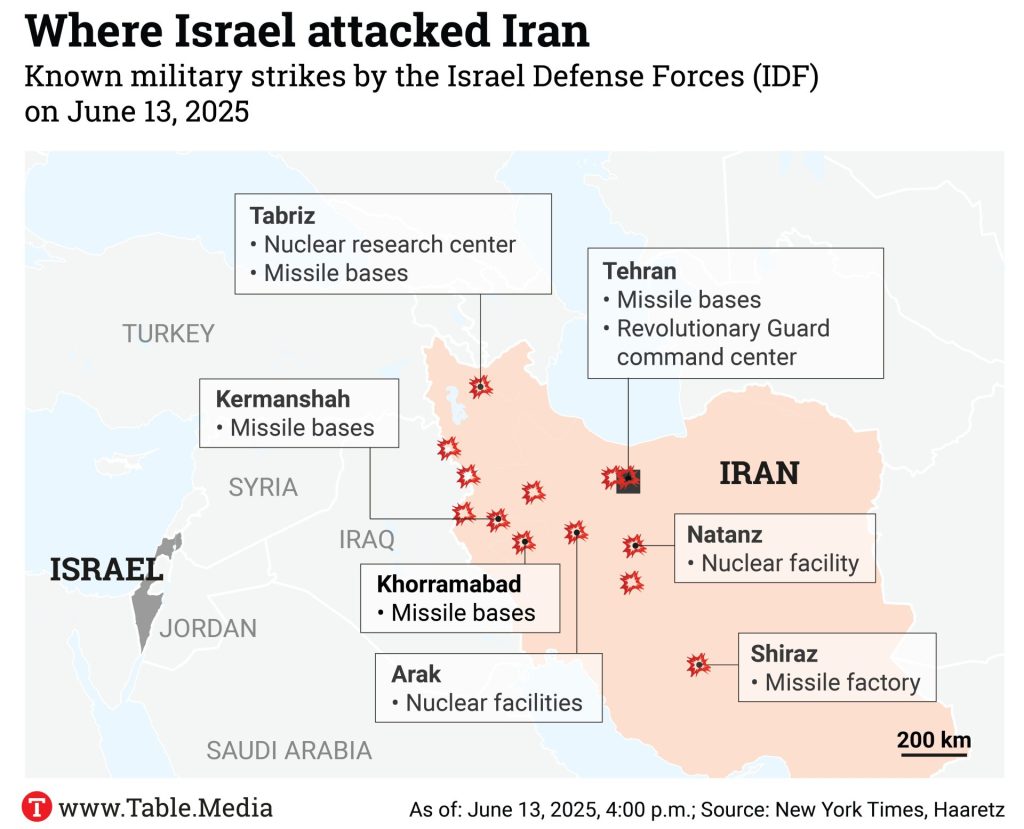

The conflict began on June 13, 2025, when Israel launched a surprise offensive against Iran’s nuclear facilities, including Fordow, Natanz, and Isfahan, using small drones and precision-guided missiles. Iran retaliated with missile strikes on Israel and, on June 23, targeted the U.S. Al Udeid base in Qatar, though no casualties were reported due to prior warnings to Qatari officials. U.S. President Donald Trump announced a ceasefire on June 23, claiming it would phase in over 24 hours, a move both Israel and Iran accepted by June 24.

Despite the ceasefire, tensions persist. Israel’s military warned that “danger persists,” lifting restrictions on public gatherings but maintaining heightened alertness. Iranian President Masoud Pezeshkian declared the war’s end a “total victory,” emphasizing national resilience, while Israel’s Prime Minister Benjamin Netanyahu hailed a “historic victory” and vowed to continue targeting Iran’s “axis” with Hamas. A classified U.S. intelligence report, disputed by the White House, suggested that American airstrikes did not fully destroy Iran’s nuclear sites, raising concerns about Tehran’s future nuclear ambitions.

The conflict’s toll is significant: Iran reported 950 deaths, including civilians, soldiers, and prisoners, with the Evin Prison attack drawing accusations of war crimes from Nobel laureate Narges Mohammadi. Iran’s parliament also approved suspending cooperation with the International Atomic Energy Agency (IAEA), signaling defiance against Western oversight.

What’s Next for the Region?

The ceasefire’s fragility raises several possibilities for the Middle East:

- Diplomatic Efforts: European leaders, including EU diplomat Kaja Kallas, and India have urged dialogue to prevent escalation, with Qatar emerging as a key mediator due to its role in prior Gaza talks. Indirect U.S.-Iran talks, brokered by Oman since April 2025, may resume to address Iran’s nuclear program.

- Potential Retaliation: Iran’s armed forces chief vowed “firm action” if the U.S. or Israel resumes strikes, and Tehran’s parliament threatened to close the Strait of Hormuz, a critical oil route. Such a move could trigger a global energy crisis.

India’s Response: A Call for Diplomacy

India has maintained a neutral stance, prioritizing de-escalation and diplomacy. On June 13, the Ministry of External Affairs (MEA) issued a statement urging all parties to utilize “existing channels of dialogue and diplomacy” to de-escalate, advising Indian nationals in the region to follow local security protocols. On June 24, the MEA reiterated its call for restraint, emphasizing the need for peaceful resolutions to avoid further destabilization.

India’s position reflects its strategic interests:

- Diaspora Safety: With millions of Indian citizens in the Middle East, India evacuated around 100 students from Iran via Armenia on June 18 amid Israeli airstrikes.

- Energy Security: As a major importer of oil through the Strait of Hormuz, India faces risks from potential disruptions, which could spike oil prices.

- Geopolitical Balance: India abstained from a Shanghai Cooperation Organization (SCO) statement condemning Israel’s strikes, reflecting its strong ties with Israel, a key arms supplier, while maintaining relations with Iran to counterbalance Pakistan.

- Regional Connectivity: The India-Middle East-Europe Corridor (IMEC) could face delays due to regional instability, impacting India’s trade ambitions.

The conflict disrupted India’s diplomatic calendar, with Egypt’s Foreign Minister postponing a planned visit to New Delhi on June 23 due to regional tensions. India’s consistent messaging underscores its preference for stability to protect its economic and security interests.

China’s Actions: Economic Concerns Drive Restraint

China, a major importer of Iranian oil, has adopted a cautious approach, prioritizing economic stability over confrontation. Beijing relies on the Strait of Hormuz for half its oil imports, and any escalation risks price surges or supply disruptions. After Israel’s initial strikes, China’s top leader, Xi Jinping, called for a ceasefire during a call with Russian President Vladimir Putin, avoiding direct criticism of Israel or the U.S.

China’s UN ambassador, Fu Cong, warned that U.S. strikes damaged its credibility and risked an “out-of-control” conflict, urging all parties to return to diplomacy. Beijing’s limited influence was evident, as it could only exert pressure through the UN Security Council, where it holds a permanent seat. Analysts suggest China sees a prolonged U.S. involvement as a potential diversion of American resources from Asia, but its primary goal is to avoid a wider war that could harm its economy.

Russia’s Actions: Limited Support for Iran

Russia, a strategic partner of Iran, has provided rhetorical support but avoided direct involvement. President Putin emphasized that Russia’s “strategic partnership” with Iran does not include defense cooperation, signaling reluctance to escalate. After U.S. strikes, Russia condemned the attacks as violations of international law but offered no military backing, focusing instead on calls for dialogue.

Russia’s restrained response reflects its preoccupation with Ukraine, where Iran has supplied military aid. Moscow’s limited actions suggest it prioritizes its own strategic interests over deeper entanglement in the Middle East.

What’s Next for the Region?

The ceasefire’s durability remains uncertain, with several potential scenarios:

- Diplomatic Progress: Iran’s President Pezeshkian signaled openness to nuclear talks, but Israel’s distrust of negotiations and Iran’s IAEA suspension complicate prospects. Former Iranian diplomat Seyed Hossein Mousavian suggested direct U.S.-Iran negotiations as the only path forward.

- Renewed Conflict: Israel’s vow to strike if Iran rebuilds its nuclear program, coupled with Iran’s threats of retaliation, risks reigniting hostilities. Iran’s dwindling missile stockpiles (down from ~2,000 to ~1,300–1,600) and damaged launchers limit its offensive capacity, but proxy groups like Hezbollah or the Houthis could escalate tensions.

- Nuclear Ambitions: If Iran retains enough highly enriched uranium, as suggested by some reports, it could pursue a nuclear weapon, though experts argue this is unlikely given regime stability concerns.

- Regional Fallout: The conflict has sidelined the Gaza war, with Israeli reservists demanding a ceasefire to secure hostages, while Palestinian casualties continue. A wider war involving U.S. bases or Gulf states remains a risk.

Broader Implications and India’s Role

The Israel-Iran-USA conflict underscores the fragility of Middle East stability, with global implications for oil markets, trade routes, and geopolitics. India’s neutral stance positions it as a potential mediator, leveraging its ties with Israel, Iran, and Gulf nations. However, its primary focus remains protecting its diaspora, energy supplies, and trade corridors like the IMEC.

China and Russia’s restrained responses highlight their limited ability to counter U.S. and Israeli military dominance, pushing them toward diplomatic channels. The conflict’s outcome could shape global power dynamics, with India’s call for dialogue aligning with calls from the UN, EU, and others for a return to negotiations.

How It Impacts Global Business and VC Investments

The conflict has significantly disrupted global business operations, particularly in energy, aviation, and trade:

- Oil Price Volatility: Brent crude surged 10–13% to $75–78 per barrel during the conflict, driven by fears of disruptions in the Strait of Hormuz, through which 20% of global oil (18–21 million barrels daily) flows. Iran’s threats to blockade the strait heightened concerns, though no closure occurred. The price spike risks inflation, with a 10% oil price increase potentially adding 0.4% to consumer prices over a year. This affects industries like manufacturing, logistics, and retail, particularly in oil-dependent economies like India and China.

- Aviation and Tourism Disruptions: Airlines such as Emirates and Etihad suspended flights to Iran, Iraq, Jordan, and Lebanon until June 30, with Israel and Iran closing airspace. This disrupted global supply chains and tourism, hitting Middle Eastern economies reliant on travel revenue.

- Trade and Supply Chain Risks: The conflict, combined with Trump’s tariff policies, has strained global trade. The World Bank cut its 2025 global growth forecast to 2.3%, citing tariffs and Middle East instability. A prolonged conflict or Strait closure could paralyze shipping, impacting exports from Asia and Europe.

- Regional Economic Fallout: Iran, a key oil supplier to China and India, faces reduced exports due to sanctions and conflict damage, notably at the South Pars gas field. Israel’s high-tech sector, a global innovation hub, remains resilient but faces risks from prolonged conflict, with stagnant high-tech employment growth since 2022.

Impact on Venture Capital Investments

The conflict has created both challenges and opportunities for VC investments, reshaping investor priorities:

- Market Volatility and Risk Aversion: Global equity markets dipped initially, with the S&P 500 and Dow dropping 0.7–2% on June 13, reflecting investor concerns about escalation. However, markets rebounded by June 17 as fears of a wider war eased, with the S&P 500 up 1% and MSCI World Index near record highs. VC investors have adopted a cautious stance, with mergers and acquisitions (M&A) slowing due to geopolitical uncertainty.

- Safe-Haven Shifts: Investors moved toward gold, U.S. dollars, and government bonds during the conflict, reducing capital flows to riskier VC-backed startups, particularly in emerging markets. High-yield credit spreads increased only 2 basis points, signaling modest risk aversion, but prolonged uncertainty could further dampen VC appetite.

- Sector-Specific Impacts: Energy and defense sectors saw gains, with the S&P 500 energy index up 2% and defense stocks like Rheinmetall and BAE rising 2–3%. VC interest in clean energy and defense tech may grow, driven by rising oil prices and security concerns. Conversely, travel and leisure startups face headwinds due to regional disruptions.

- Opportunities in Israel’s Tech Sector: Despite short-term risks, Israel’s high-tech industry, contributing 20% to GDP and 64% to exports, remains a VC magnet. Investors see long-term potential in cybersecurity and AI, though prolonged conflict could strain funding if missile attacks disrupt operations.

- Global VC Outlook: X posts highlight potential investment opportunities in energy and defense tech amid the conflict, but warn of declining consumer confidence and tourism impacting broader VC ecosystems. The conflict’s limited duration suggests a short-term impact, with markets historically recovering within weeks of geopolitical shocks.

Conclusion

The Israel-Iran-USA conflict has disrupted international business through oil price volatility, aviation halts, and trade uncertainties, while VC investments face short-term caution but long-term opportunities in energy and tech. India, China, and Russia’s calls for restraint highlight global stakes, with energy security and trade routes at risk. As the ceasefire holds, businesses and investors must navigate uncertainty, balancing risks with emerging opportunities in a volatile geopolitical landscape.

Technocrat Magazine will continue to track this conflict’s impact on global markets and innovation.

Comments