Pamulaparti Venkata Narasimha Rao, India’s 9th Prime Minister (1991–1996), is celebrated as the “Father of Indian Economic Reforms” for steering the nation from the brink of collapse to a global economic powerhouse. His bold policies dismantled the License Raj, opened India to foreign investment, and laid the foundation for modern hubs like Bengaluru and New Delhi to thrive as magnets for investors. On his birth anniversary, we explore Rao’s monumental contributions and why cities like Bengaluru and New Delhi remain prime destinations for global capital. Discover how his legacy fuels opportunities at YTC Ventures, a platform empowering innovative investments in India’s growth story.

From Crisis to Catalyst: Rao’s Economic Revolution

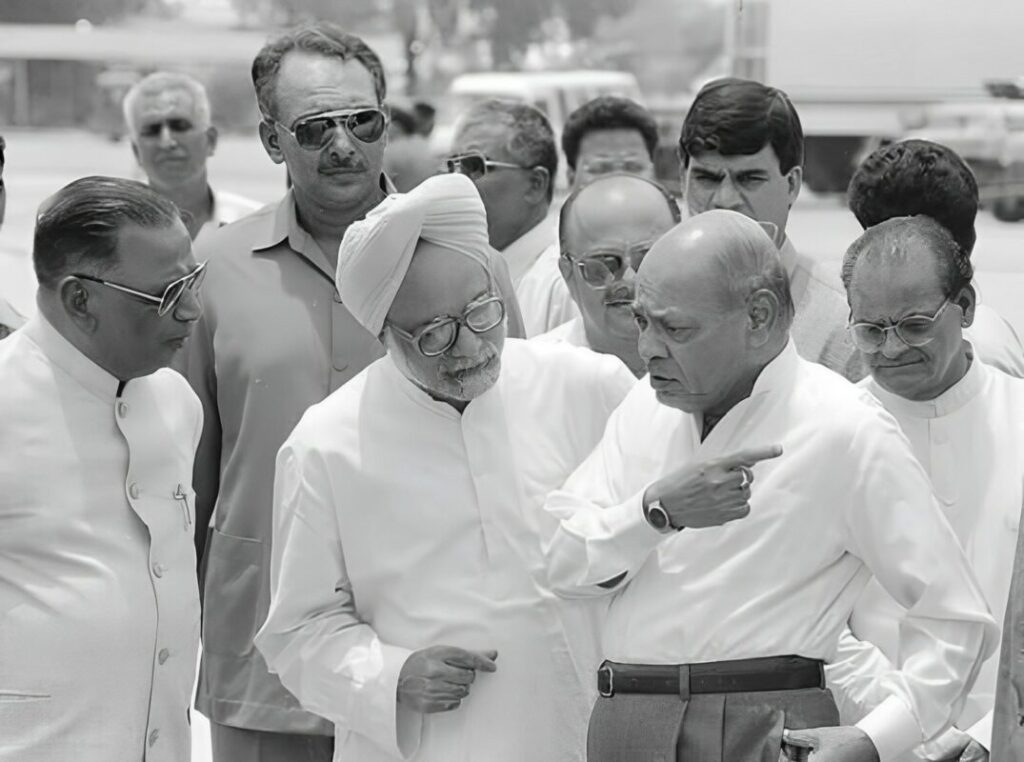

In June 1991, when Rao assumed office, India faced an unprecedented economic crisis. Foreign exchange reserves dwindled to $1.2 billion, barely covering two weeks of imports, with a fiscal deficit at 8% of GDP and double-digit inflation. The collapse of the Soviet Union and the Gulf War’s oil price spike exacerbated the situation. Rao, a scholar-statesman fluent in 17 languages, rose to the challenge with political acumen and a visionary team, including Finance Minister Manmohan Singh.

Rao’s 1991 economic reforms were a paradigm shift. He abolished the License Raj, a bureaucratic stranglehold on businesses, and introduced liberalization, privatization, and globalization (LPG) policies. The New Industrial Policy of 1991 eliminated licensing for most industries, allowed up to 51% foreign direct investment (FDI), and relaxed the Monopolies and Restrictive Trade Practices (MRTP) Act. These measures, coupled with a two-step rupee devaluation (18.7% against the US dollar), opened India to global markets. As Manmohan Singh noted in 2020, “It was a hard choice and a bold decision… possible because Prime Minister Narasimha Rao gave me the freedom to roll out things”.

The results were transformative. India’s GDP growth surged from 1.06% in 1991 to 7.57% by 1995. Foreign exchange reserves soared to over $500 billion by 2020, and India’s global trade share rose from 0.5% in 1991 to 2% by 2022. Rao’s reforms created jobs, reduced poverty, and positioned India as a go-to destination for FDI, with inflows rising from $97 million in 1991 to $82 billion by 2021

Bengaluru: The Silicon Valley of India

Rao’s liberalization unleashed Bengaluru’s potential as a global tech hub. By dismantling barriers to private and foreign investment, he enabled the IT sector’s meteoric rise. Bengaluru, already home to institutions like the Indian Institute of Science, became a magnet for tech giants and startups. Companies like Infosys and Wipro, founded in the 1980s, scaled rapidly post-1991, leveraging Rao’s policies to access global markets and capital. Today, Bengaluru hosts over 7,000 startups and contributes 40% of India’s IT exports.

For investors, Bengaluru offers unparalleled opportunities. The city’s robust ecosystem—spanning AI, biotech, and fintech—makes it a hotspot for venture capital. YTC Ventures connects investors to Bengaluru’s dynamic startups, offering high-growth prospects in a city shaped by Rao’s vision. With infrastructure projects like the Bengaluru Metro and a thriving talent pool, the city remains a top choice for global funds seeking exponential returns.

New Delhi: The Policy and Investment Nexus

New Delhi, as India’s political and administrative capital, also reaped the benefits of Rao’s reforms. His policies attracted FDI in sectors like telecommunications, infrastructure, and finance, transforming Delhi into a hub for corporate headquarters and policy innovation. The city’s proximity to decision-makers and its world-class connectivity via the Indira Gandhi International Airport make it a strategic base for investors. Rao’s Look East policy, fostering ties with Southeast Asia, further amplified Delhi’s role as a diplomatic and economic bridge.

Today, New Delhi’s real estate, fintech, and renewable energy sectors draw significant investment. The city’s startup ecosystem, supported by initiatives like Startup India, thrives on Rao’s legacy of deregulation. Investors can explore these opportunities through YTC Ventures, which offers curated access to high-potential ventures in Delhi’s vibrant market.

PV Narasimha Rao’s Biggest Financial Policy Changes and Their Lasting Impact

Pamulaparti Venkata Narasimha Rao’s tenure as India’s Prime Minister (1991–1996) marked a turning point for the Indian economy, driven by bold financial policy reforms that dismantled barriers and fueled growth. Facing a 1991 economic crisis with foreign exchange reserves at $1.2 billion and a fiscal deficit of 8% of GDP, Rao, alongside Finance Minister Manmohan Singh, introduced transformative measures that reshaped India’s financial landscape. These policies not only averted collapse but also positioned cities like Bengaluru and New Delhi as global investment hubs. Explore how Rao’s vision continues to drive opportunities at YTC Ventures.

Abolition of the License Raj: Rao’s New Industrial Policy of 1991 eliminated licensing requirements for most industries, freeing businesses from bureaucratic red tape. This unleashed entrepreneurial energy, enabling firms in Bengaluru’s IT sector, like Infosys, to scale rapidly. By 2020, India’s IT industry contributed 8% to GDP, with Bengaluru accounting for 40% of IT exports.

Foreign Direct Investment (FDI) Liberalization: Allowing up to 51% FDI in priority sectors, Rao opened India to global capital. FDI inflows surged from $97 million in 1991 to $82 billion by 2021, fostering growth in New Delhi’s telecom and infrastructure sectors. This policy attracted multinationals like IBM to Bengaluru, cementing its status as India’s Silicon Valley.

Rupee Devaluation: A two-step devaluation of the rupee by 18.7% in 1991 boosted exports by making Indian goods competitive globally. Exports grew from $18 billion in 1991 to $42 billion by 1996, strengthening India’s trade balance and fueling job creation in urban centers like New Delhi.

Privatization and Public Sector Reforms: Rao reduced government control over public sector enterprises, encouraging efficiency and private participation. This spurred infrastructure development in New Delhi and tech innovation in Bengaluru, creating a robust ecosystem for startups and investors.

Impact on India’s Economy:

Rao’s reforms drove GDP growth from 1.06% in 1991 to 7.57% by 1995. Foreign exchange reserves climbed to $500 billion by 2020, and poverty rates dropped from 45% in 1991 to 22% by 2011. Bengaluru emerged as a global tech hub, hosting 7,000+ startups, while New Delhi became a policy and fintech powerhouse, attracting $10 billion in FDI annually by 2023. These cities, shaped by Rao’s policies, offer high-ROI opportunities for investors through platforms like YTC Ventures.

Rao’s financial reforms laid the foundation for India’s rise as the world’s fifth-largest economy, making Bengaluru and New Delhi prime destinations for global capital. YTC Ventures connects investors to these dynamic markets, channeling Rao’s legacy into modern wealth creation.

Raomissing Economic and Social Legacy

While Rao’s economic reforms are his hallmark, his tenure was not without challenges. The 1992 Babri Masjid demolition and subsequent riots posed significant social hurdles, and corruption scandals, like the Jharkhand Mukti Morcha bribery case, sparked controversy. Yet, his ability to navigate a minority government and secure bipartisan support for reforms showcased his political genius, earning him the title “Chanakya of Modern India”.

Rao’s foreign policy, including normalizing ties with Israel and engaging investors at the World Economic Forum in Davos, further integrated India into the global economy. His intellectual depth as a polyglot scholar and his strategic restraint—allowing Manmohan Singh to be the face of reforms—underscored his nuanced leadership.

Why Invest in Rao’s India?

Rao’s reforms laid a solid foundation for India’s economic ascent, making it the world’s fifth-largest economy today. Bengaluru and New Delhi, as epicenters of innovation and policy, embody his vision of a market-driven India. For investors, these cities offer:

- Bengaluru: A tech-driven economy with high ROI potential in startups and R&D centers.

- New Delhi: Access to policy influencers, infrastructure projects, and a burgeoning fintech sector.

YTC Ventures bridges investors to these opportunities, offering insights into India’s high-growth markets. Rao’s legacy of bold reforms continues to drive prosperity, making now the perfect time to invest in India’s future.

Join the economic revolution sparked by PV Narasimha Rao. Visit YTC Ventures to explore investment opportunities in Bengaluru and New Delhi, and stay tuned to Technocrat Magazine Online for more insights into India’s business landscape.

Comments