To assess whether Iran’s military capabilities could “take down” the Israel Defense Forces (IDF) and determine who has the upper hand in their ongoing conflict as of June 17, 2025, we need to compare their military strengths, strategic advantages, and recent conflict dynamics. The analysis draws on available data about personnel, equipment, technology, budgets, and recent engagements, while critically examining the broader geopolitical context.

Military Capabilities: Iran vs. Israel

Manpower

- Iran:

- Active personnel: ~610,000 (350,000 army, 190,000 Islamic Revolutionary Guard Corps (IRGC), 18,000 navy, 37,000 air force, 15,000 air defense).

- Reserves: ~350,000.

- Paramilitary: ~220,000.

- Total population: ~87.6 million, providing a large recruitment pool.

- Mandatory conscription for men over 18.

- Israel:

- Active personnel: ~169,500 (126,000 army, 9,500 navy, 34,000 air force).

- Reserves: ~465,000.

- Paramilitary: ~8,000.

- Total population: ~9 million, limiting long-term manpower sustainability.

- Mandatory conscription for most men and women over 18.

Assessment: Iran has a significant numerical advantage in active personnel and potential recruits due to its larger population. However, Israel’s reserve system is highly trained and mobilized quickly, compensating for its smaller active force. Iran’s IRGC is ideologically driven but less versatile than Israel’s professional, technology-focused IDF.

Air Forces

- Iran:

- Combat-capable aircraft: ~312 (plus 23 IRGC aircraft), including outdated F-4s, F-5s, MiG-29s, and Sukhoi-24s, acquired pre-1979 or in the 1990s.

- Attack helicopters: ~57 (2 air force, 50 army, 5 IRGC).

- Drones: Thousands, including long-range models like Mohajer-10 (1,240-mile range, 24-hour flight).

- Air defenses: Russian S-200, S-300, and domestic Bavar-373, Sayyad, and Raad systems. These are less battle-tested and struggled against Israeli strikes in 2024-2025.

- Israel:

- Combat-capable aircraft: ~345, including advanced F-15s, F-16s, and F-35 stealth fighters.

- Attack helicopters: 43 (e.g., AH-64 Apache).

- Drones: Advanced models like Heron (30+ hour endurance) and Delilah loitering munitions.

- Air defenses: Multi-layered system including Iron Dome (short-range), David’s Sling (medium-range), and Arrow (long-range), highly effective against missiles and drones, with 99% interception rates in some attacks.

Assessment: Israel holds overwhelming air superiority due to its modern, U.S.-supplied aircraft, stealth capabilities, and integrated air defenses. Iran’s air force is outdated, reliant on legacy systems, and hampered by sanctions, limiting its ability to compete in air-to-air combat or penetrate Israeli airspace. Iran’s drone and missile programs are its primary offensive tools, but Israel’s defenses have neutralized most attacks.

Missile and Nuclear Capabilities

- Iran:

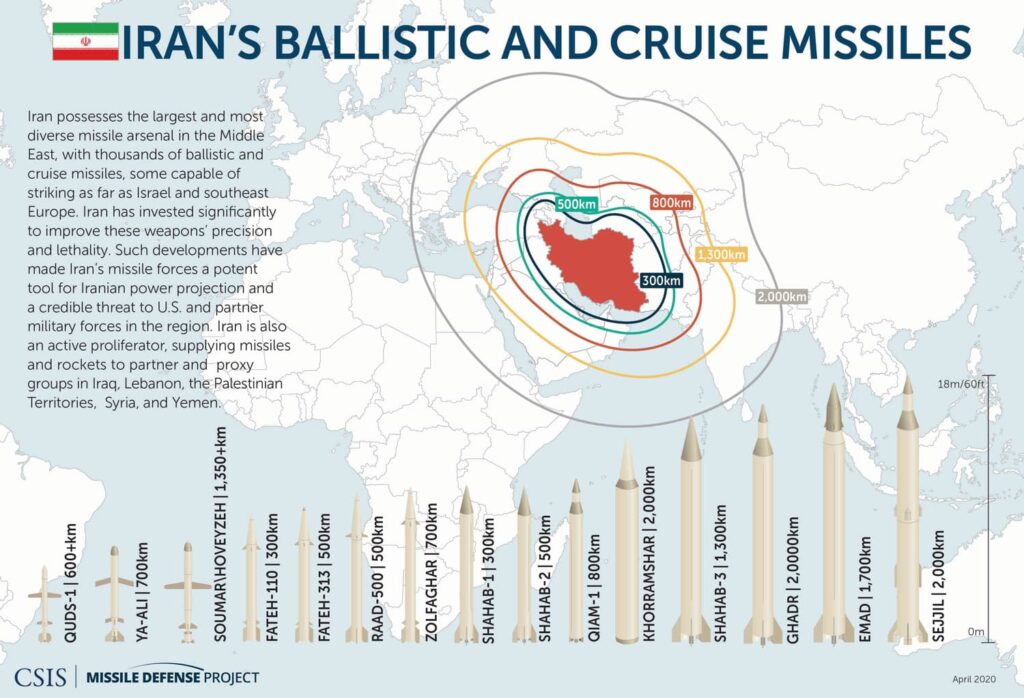

- Ballistic missiles: ~3,500, including short- to medium-range models like Tondar-69 (150 km), Shahab-3, Sejjil, and Khorramshahr (up to 2,000 km). Newer hypersonic missiles like Fatah and Haj Qassem have shown improved evasion capabilities.

- Cruise missiles and anti-ship missiles enhance regional reach.

- Nuclear program: No confirmed nuclear weapons, but advanced uranium enrichment raises concerns. Supreme Leader Khamenei’s fatwa bans nuclear weapon production, though skepticism persists.

- Israel:

- Ballistic missiles: Includes LORA (280 km) and Jericho-3 (4,800–6,500 km, potential ICBM).

- Nuclear capability: Estimated 90–200 warheads (unconfirmed due to “nuclear ambiguity” policy), deliverable via missiles and aircraft.

- Missile defenses: Iron Dome, David’s Sling, and Arrow systems, integrated with U.S. interceptors, provide robust protection.

Assessment: Iran’s missile arsenal is its strongest asset, capable of striking Israel from afar, but its effectiveness is reduced by Israel’s advanced defenses and less reliable missile technology (e.g., ~50% failure rate in some launches). Israel’s nuclear deterrent and longer-range missiles give it a strategic edge, though nuclear escalation remains unlikely.

Naval Forces

- Iran:

- 17 tactical submarines, 68 patrol/coastal combatants, 7 corvettes, 12 landing ships, 11 landing craft, 18 logistics/support vessels.

- Focus on asymmetric warfare in the Persian Gulf, using small, fast attack craft and mines.

- Israel:

- 5 submarines, 49 patrol/coastal combatants, 7 corvettes, no frigates.

- Advanced technology and Western support enhance naval effectiveness despite smaller size.

Assessment: Iran’s larger naval presence suits its regional strategy (e.g., controlling the Strait of Hormuz), but Israel’s navy is technologically superior and sufficient for its Mediterranean-focused defense. Naval conflict is unlikely to be decisive given geographic separation.

Land Forces

- Iran:

- Tanks: ~1,996.

- Armored vehicles: ~65,765.

- Artillery: ~7,000 (775 rocket artillery).

- Israel:

- Tanks: ~1,370 (more advanced, e.g., Merkava).

- Armored vehicles: ~43,407.

- Artillery: ~650 self-propelled, 150 rocket artillery.

Assessment: Iran outnumbers Israel in tanks and vehicles, but Israel’s equipment is more modern, and its forces are better trained. Ground combat is unlikely due to geographic distance (1,850 km between Jerusalem and Tehran), making this less relevant.

Defense Budget and Technology

- Iran:

- 2023 budget: ~$10.3 billion (0.6% increase from 2022).

- IRGC funding often exceeds official budgets via non-state channels.

- Sanctions limit access to advanced technology, forcing reliance on domestic production.

- Israel:

- 2023 budget: ~$27.5 billion (24% increase from 2022, driven by Gaza conflict).

- Strong U.S. military aid (~$3.8 billion annually) and access to cutting-edge technology.

- Global Firepower Index 2025 ranks Israel 15th (PwrIndx: 0.2661) vs. Iran 16th (PwrIndx: 0.3048).

Assessment: Israel’s higher budget, U.S. support, and technological edge enable a more efficient, advanced military. Iran’s lower budget and sanctions constrain modernization, though its domestic missile and drone programs are cost-effective.

Proxy Forces and Alliances

- Iran:

- “Axis of Resistance” includes Hezbollah (Lebanon, ~120,000–200,000 rockets), Hamas (Gaza), Houthis (Yemen), and militias in Iraq and Syria.

- Russian support provides some advanced systems (e.g., S-300), but limited compared to U.S. aid to Israel.

- Proxy strategy allows Iran to strike Israel indirectly, preserving its own forces.

- Israel:

- Strong U.S. backing (military aid, intelligence, and interceptors).

- Regional alliances with Jordan, UAE, and others (via Abraham Accords) bolster defense.

- Limited proxy use, but supports anti-Iran groups like the People’s Mujahedin of Iran

Assessment: Iran’s proxies extend its reach but are less effective against Israel’s conventional forces. Israel’s alliances, particularly with the U.S., provide unmatched strategic depth, including access to advanced weaponry and intelligence.

Could Iran “Take Down” the IDF?

“Taking down” the IDF implies defeating Israel’s military to the point of collapse or rendering it incapable of defending the state. This is highly unlikely for several reasons:

- Geographic Constraints:

- The 1,850 km distance between Iran and Israel precludes sustained ground or naval engagements. Conflict would rely on air, missile, and drone strikes, where Israel holds advantages in defense and precision.

- Iran’s proxies (e.g., Hezbollah) can harass Israel but lack the capacity to decisively overwhelm the IDF, especially after recent losses (e.g., Hezbollah leader Hassan Nasrallah killed in 2024).

- Technological and Defensive Superiority:

- Israel’s air defenses (Iron Dome, etc.) have intercepted ~99% of Iranian missiles and drones in attacks like April 2024, minimizing damage.

- Israel’s F-35s and precision munitions can strike Iranian targets with minimal resistance, as demonstrated in June 2025 strikes on nuclear and missile sites.

- Nuclear Deterrent:

- Israel’s presumed nuclear arsenal serves as a last-resort deterrent, discouraging existential threats from Iran, which lacks nuclear weapons.

- Iran’s nuclear facilities are vulnerable to Israeli (or U.S.) strikes, as shown in Operation Rising Lion (June 2025).

- Iran’s Vulnerabilities:

- Iran’s air defenses are less effective, allowing Israeli jets to penetrate deep into its territory.

- Sanctions and economic challenges limit Iran’s ability to sustain a prolonged high-intensity conflict.

- Recent Israeli strikes killed senior IRGC commanders (e.g., Mohammad Bagheri, Hossein Salami), disrupting Iran’s military leadership.

- Israel’s Resilience:

- The IDF’s experience in multiple regional conflicts (e.g., Gaza, Lebanon) and rapid mobilization of reserves enhance its adaptability.

- U.S. and regional support ensures Israel can replenish munitions and maintain operations longer than Iran.

Assessment: Iran’s missile and drone arsenal poses a serious threat, capable of causing damage and casualties, but it cannot decisively defeat the IDF. Israel’s technological edge, air superiority, and robust defenses make it highly resilient. Iran’s best chance lies in asymmetric warfare via proxies, but these have been weakened by Israeli operations (e.g., against Hezbollah in 2024). A full-scale war would likely result in significant Iranian losses with limited strategic gains.

Who Is Winning Now (June 17, 2025)?

The Iran-Israel conflict, escalating since October 2023, has shifted from proxy warfare to direct strikes. Recent events provide insight into the current balance:

Recent Conflict Dynamics

- Iran’s Actions:

- October 1, 2024: Iran launched ~180 ballistic missiles at Israel, most intercepted, causing minimal damage.

- June 13–16, 2025: Iran fired ~270 missiles and 100+ drones under “True Promise 3,” killing at least 14 Israelis and causing damage (e.g., Bat Yam apartment block, northern refinery). However, Israel’s defenses intercepted most projectiles.

- Iran’s newer missiles (e.g., Haj Qassem) evaded some defenses, showing improved capabilities, but overall impact was limited.

- Iran’s air defenses struggled against Israeli strikes, with losses including senior commanders and nuclear scientists.

- Israel’s Actions:

- October 26, 2024: Israel struck Iranian military sites in retaliation for the October 1 attack, targeting missile production and air defenses.

- June 12–16, 2025 (Operation Rising Lion): Israel launched preemptive strikes on Iran’s nuclear facilities, missile factories, and military targets, using ~200 fighter jets. Key outcomes:

- Partial destruction of Natanz nuclear facility.

- Elimination of IRGC leaders (e.g., Mohammad Bagheri, Hossein Salami) and nuclear scientists (e.g., Fereydoon Abbasi).

- Dismantled 20+ surface-to-surface missiles and struck ~100 targets in Isfahan and Tehran.

- Israel’s strikes exposed Iran’s defensive vulnerabilities, with minimal losses to its own forces.

Current Status

- Israel’s Advantages:

- Successful deep strikes into Iran demonstrate operational superiority and intelligence precision.

- Minimal damage from Iranian missile barrages due to effective defenses.

- Weakening of Iran’s proxies (e.g., Hezbollah’s leadership losses in 2024) and direct hits on IRGC leadership disrupt Iran’s command structure.

- U.S. support, including interceptors and intelligence, bolsters Israel’s resilience.

- Iran’s Advantages:

- Large missile stockpile allows sustained barrages, with some advanced missiles penetrating Israeli defenses.

- Proxies like Hezbollah and Houthis continue low-level harassment, stretching IDF resources.

- Iran’s rhetoric of “blood for blood” maintains domestic support, though economic strain limits escalation.

Who Is Winning?

- Israel holds the upper hand as of June 17, 2025. Its ability to conduct precise, high-impact strikes deep in Iran, coupled with robust defenses that mitigate Iranian missile attacks, gives it a strategic advantage. The IDF’s elimination of key Iranian commanders and damage to nuclear and missile facilities have significantly weakened Iran’s offensive and defensive capabilities.

- Iran’s missile barrages have caused some damage and casualties, but their overall impact is limited by Israel’s defenses and Iran’s own losses. Iran’s proxies remain active but are less effective after Israeli operations.

- However, the conflict remains volatile. Iran’s large missile arsenal and willingness to retaliate could prolong the exchange, potentially escalating if either side miscalculates. Both seek to avoid all-out war due to high costs, with Iran constrained by economic sanctions and Israel by multi-front threats (e.g., Gaza, Lebanon).

Critical Considerations

Geopolitical Context: The U.S. plays a pivotal role, supporting Israel while urging restraint to avoid a broader war. President Trump’s mixed signals (praising Israel’s strikes but warning Iran) complicate diplomacy. Iran avoids direct U.S. confrontation, knowing it risks overwhelming retaliation.

Economic and Domestic Factors: Iran’s economy, strained by sanctions, limits its ability to sustain high-intensity conflict. Israel’s stronger economy and U.S. aid provide greater endurance, but prolonged conflict could strain its resources amid Gaza and Lebanon operations.

Proxy Dynamics: Iran’s “Axis of Resistance” remains a wildcard, but Hezbollah’s 2024 losses and Syria’s 2024 regime collapse weaken Iran’s regional influence.

Nuclear Risk: Israel’s strikes on Iran’s nuclear sites aim to delay its program, but escalation could push Iran to accelerate enrichment, raising global concerns.

Conclusion

Iran’s war machine, while formidable in manpower and missile capabilities, cannot “take down” the IDF due to Israel’s technological superiority, air dominance, robust defenses, and U.S. support. Iran’s strength lies in asymmetric warfare and sustained missile barrages, but these have not decisively shifted the balance. As of June 17, 2025, Israel is winning the direct conflict, having inflicted significant damage on Iran’s military and nuclear infrastructure while minimizing its own losses. However, the risk of escalation persists, and Iran’s proxies and missile reserves ensure the conflict remains unresolved. Both sides face pressure to de-escalate to avoid a catastrophic regional war.

Comments