Apple is reported as the worst-performing Big Tech stock this year, facing challenges like slowing iPhone sales, a declining market share in China (down to 15% in Q1 2025 from 21% in Q4 2023), regulatory scrutiny on its services, and a lackluster AI rollout. These factors have raised concerns among investors.

Apple’s challenges in 2025, as reflected in recent business news and real-time financial data, center on several key issues impacting its performance:

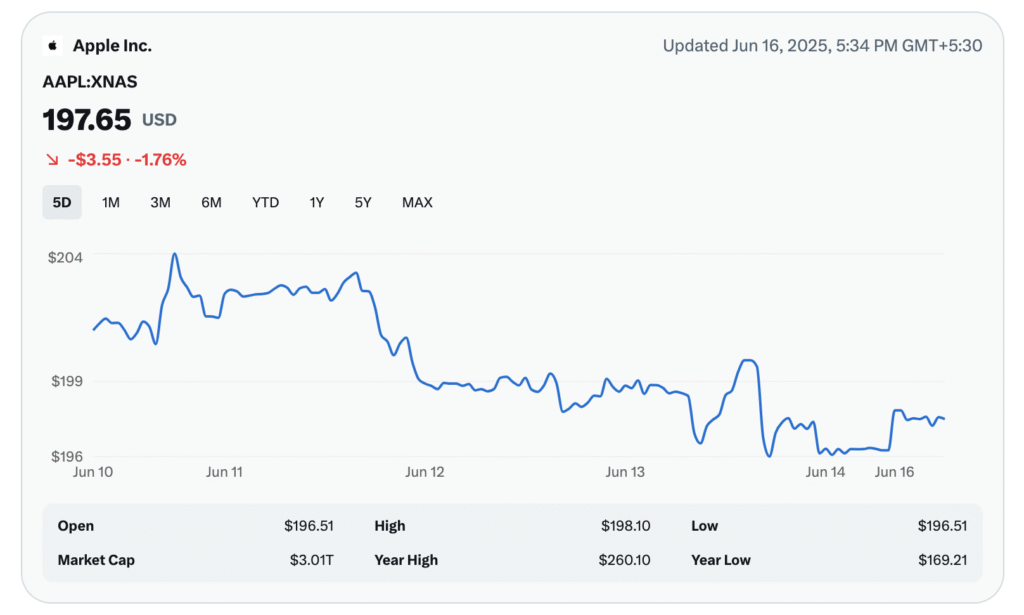

Current stock price is $197.65, down from a year-high of $260.10

Monthly data indicates a downward trend, with the price dropping from $208.90 on May 19, 2025, to $197.65 on June 16, 2025, reflecting a roughly 5.4% decline over the past month.

- Slowing iPhone Sales: Apple’s flagship product, the iPhone, is experiencing weaker demand. Sales growth has stagnated, particularly in key markets, contributing to investor concerns about the company’s core revenue driver.

- Declining Market Share in China: Apple’s market share in China, a critical growth market, fell to 15% in Q1 2025 from 21% in Q4 2023. This drop is attributed to intense competition from domestic players like Huawei and Xiaomi, which are gaining traction with competitive pricing and innovation.

- Regulatory Scrutiny: Apple faces increasing regulatory pressure, particularly on its App Store policies and service ecosystem. Antitrust investigations in multiple regions, including the U.S. and EU, are challenging its control over app distribution and in-app payments, potentially impacting service revenue.

- Lackluster AI Rollout: Apple’s AI initiatives, including updates to Siri and new AI-driven features, have been criticized as underwhelming compared to competitors like Google and Microsoft. This has led to perceptions that Apple is lagging in the AI race, a critical area for future growth.

These factors have combined to create a challenging environment for Apple in 2025, with its stock underperforming and growth prospects uncertain. Apple’s AI struggles in 2025 have significantly eroded investor confidence due to a combination of technical missteps, delays, and strategic misalignments, particularly around its “Apple Intelligence” initiative and Siri upgrades. Below is a detailed breakdown of the reasons behind the perceived AI failure and why investors are skeptical, based on recent reports and sentiment.

Key Reasons for Apple’s AI Failure in 2025

Delayed and Underwhelming Rollouts

Siri Upgrades Postponed: Apple promised a conversational, personalized Siri integrated with iPhone apps for tasks like retrieving email details or booking reservations. However, this flagship upgrade, heavily marketed as a reason to buy the iPhone 16, was delayed to 2026 due to quality issues. Craig Federighi noted that the conversational Siri “didn’t converge in the way, quality-wise, that we needed it to,” particularly for open-ended queries.

Apple Intelligence Shortcomings: The initial Apple Intelligence features launched in October 2024 (e.g., text rewriting, Siri animations, and photo slideshows) were criticized as underwhelming and buggy. For instance, a text summarization tool distorted headlines, leading to its disablement in news apps. The iPhone 16 Pro’s AI features were labeled “beta” or missing entirely, and in China, regulatory hurdles stripped the device of AI capabilities, sparking consumer backlash.

WWDC 2025 Disappointment: At WWDC 2025, Apple announced no significant Siri upgrades, focusing instead on software design and productivity, which was seen as a letdown given investor expectations for AI breakthroughs.

Technical and Hardware Constraints

Smaller AI Models: Apple’s commitment to on-device AI processing, driven by privacy concerns, limits its models to 3 billion parameters, far smaller than competitors’ trillion-parameter models like GPT-4 or Gemini 2.5. This has resulted in less capable AI, unable to handle complex queries effectively.

Hardware Limitations: Even Apple’s advanced M-series chips struggle with the memory and processing demands of larger AI models, forcing the company to scale back ambitions for tasks like image captioning instead of competing with cloud-based “frontier models.”

Privacy-First Approach: Apple’s refusal to leverage large user data sets for AI training, unlike competitors, stems from its privacy-centric ethos. This restricts its ability to develop robust large language models (LLMs), creating a “dangerous catch-22” where AI advancement conflicts with its core principles

Leadership and Organizational Issues

Internal Disarray: Reports highlight a leadership vacuum, with delayed decision-making, siloed teams, and inadequate resource allocation. John Giannandrea, hired from Google in 2018 to lead AI, was criticized for failing to secure sufficient budgets, while Craig Federighi’s late focus on generative AI caused years of lost momentum.

“Leaders do fail” – YTC Ventures

A 2025 reorganization, shifting Mike Rockwell to Siri leadership and sidelining Giannandrea, was seen as a reactive move rather than strategic.

Marketing Missteps: Apple’s marketing team overhyped Apple Intelligence before features were ready, leading to a PR disaster when promised capabilities failed to materialize. Internal demos at WWDC 2024 were later exposed as faked, further damaging credibility

Competitive Lag

Falling Behind Rivals: Competitors like OpenAI, Google, and Meta have advanced rapidly with new generative AI models, while Apple struggles to keep pace. For example, Siri remains limited to basic tasks like setting timers, while rivals offer AI capable of analyzing research papers or generating code.

China Market Challenges: In China, where Apple’s market share dropped from 21% in Q4 2023 to 15% in Q1 2025, domestic rivals like Huawei offer more advanced AI features. Apple’s partnership with Alibaba for AI services in China lacks a clear timeline, further weakening its position

China’s Apple Market dropped 21% in Q4 2023 & 15% IN Q1 2025.

OpenAI, Google, and Meta have advanced rapidly with new generative AI models, while Apple struggles to keep pace.

Public and Analyst Criticism

Why Investors Lack Trust in Apple’s AI Investment

Stock Performance Reflects Doubt:

- Apple’s stock has fallen 20% year-to-date in 2025, making it the worst performer among major tech giants. This reflects investor concerns that Apple’s AI underperformance threatens its premium pricing power and long-term growth. For instance, Morgan Stanley cut its price target from $275 to $252, citing Siri delays impacting 50% of iPhone owners’ upgrade decisions.

Missed AI-Driven Upgrade Cycle:

- Investors expected Apple Intelligence to drive a “super cycle” of iPhone upgrades, but delays and lackluster features have led to weaker sales. iPhone shipments in China fell 9% in Q1 2025, and global sales growth has slowed as rivals offer competitive AI-driven devices.

High Expectations vs. Delivery Gap:

- Apple’s $500 billion investment in U.S. infrastructure, including AI and silicon engineering, raised expectations for breakthroughs. However, the lack of tangible results, coupled with a hybrid approach relying on third-party data centers rather than proprietary LLMs, has disappointed investors.

- The overhyped WWDC 2024 promises, followed by retracted ads and class-action lawsuits from consumers misled about iPhone 16 AI features, have further eroded trust.

Strategic Misalignment:

- Investors see Apple’s reluctance to invest heavily in external AI firms (unlike Microsoft’s early OpenAI investment) as a missed opportunity.

- The company’s privacy-first, on-device AI strategy, while aligned with its brand, is perceived as a bottleneck compared to competitors’ cloud-based models, raising doubts about its ability to close the AI gap.

Apple’s partnership with OpenAI to integrate ChatGPT into Siri faced technical roadblocks and regulatory scrutiny, limiting its impact.

Long-Term Uncertainty:

- Analysts like Patrick Moorhead suggest that even by 2026, Apple may not deliver all promised AI capabilities, signaling a prolonged recovery period. Posts on X reflect sentiment that Apple’s integrated memory architecture is suited for local AI inference, but its failure to capitalize early on generative AI has left it vulnerable.

- Investors are concerned that without a clear AI strategy or major acquisitions, Apple risks ceding ground to rivals in an AI-first world, potentially weakening its ecosystem dominance

Potential for Recovery

Despite these challenges, some analysts remain cautiously optimistic:

- Apple’s $1.3 trillion App Store ecosystem and hardware-software synergy provide a strong foundation for a 2026 rebound.

- Its $133 billion cash reserve offers flexibility for acquisitions or increased R&D, though regulatory hurdles may limit options like acquiring OpenAI.

- A potential AI-powered AR glasses launch or stronger App Store growth in Q4 2025 could serve as catalysts for stock recovery.

Conclusion

Investors’ lack of trust in Apple’s AI investment stems from delayed rollouts, technical limitations, internal disarray, and a competitive lag in generative AI, compounded by overhyped marketing and a 20% stock decline. While Apple’s privacy focus and ecosystem strength offer hope for a 2026 recovery, the company must address leadership issues, embrace strategic partnerships, and deliver on promised AI features to regain investor confidence.

Comments