World of investment today is integrated, digital and real. Decision’s made in board rooms, coffee meetings, lunch dinner meetings are executed in the real world with the help of investment banking & business law professionals. The buy or sell here will be parts or whole of companies / businesses. Buying a hotel, coffee shop , airline, brewery, organic farm, food joint, travel, technology, mobile apps all come under business sale/buy or business brokerage.

In any market anywhere, three players – households, business and governments will play, rest will be history

– KKS

Client’s of the financial system will be any among the below 3.

- Household sector

- Business sector

- Government sector

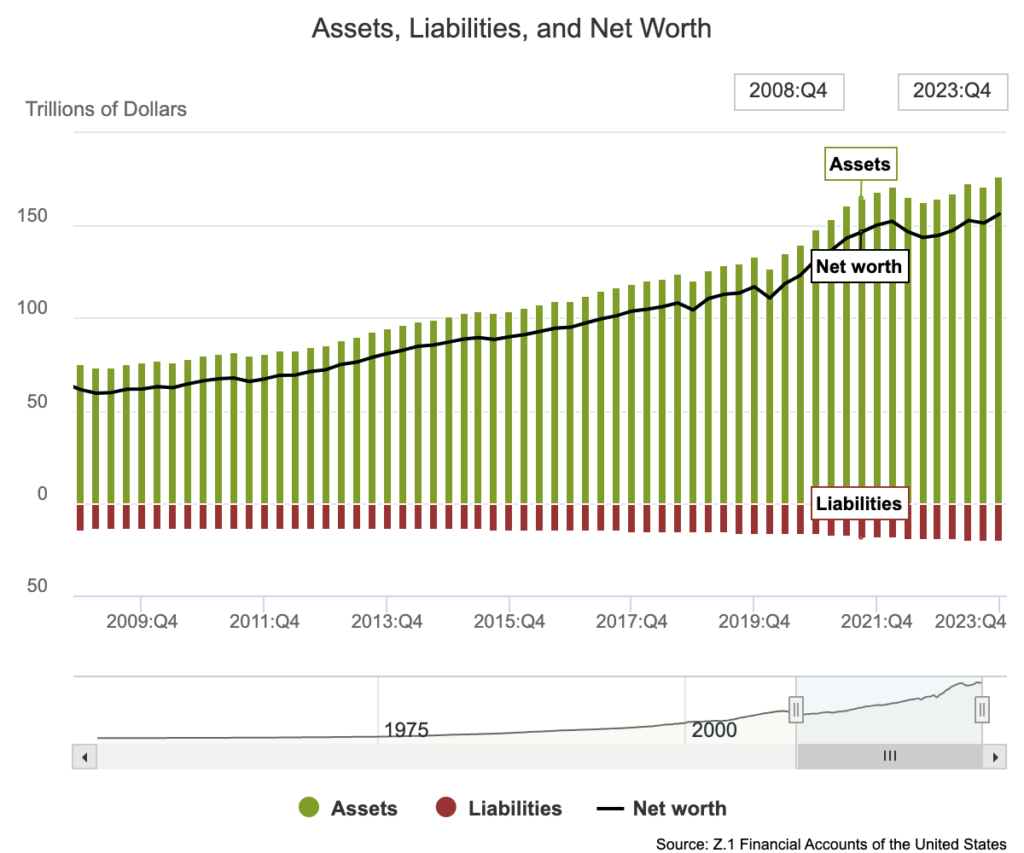

Household sector: Households make constant economic decisions concerning activities as work, job, training, retirement planning, saving versus consumption. Households are interested in a wide array of assets depending on the taxes and risk preferences.

Image 2: Balance Sheet of Households and Nonprofit Organizations, USA , 2008 – 2023. Source: https://www.federalreserve.gov/releases/z1/dataviz/z1/balance_sheet/chart/

Business sector: The major difference between the household and business sector is the approach and outlook. Households are concerned with how to invest money, whereas business need to raise money to finance their investments in real assets, plant, equipment, technology know- how and so forth. A business will have a heavy concentrated tangible assets in its balance sheet. Business raise money either in two ways. They can borrow it from banks or directly from households by issuing bonds or they can take a new – partners” by issuing stocks which are ownership shares in the firm.

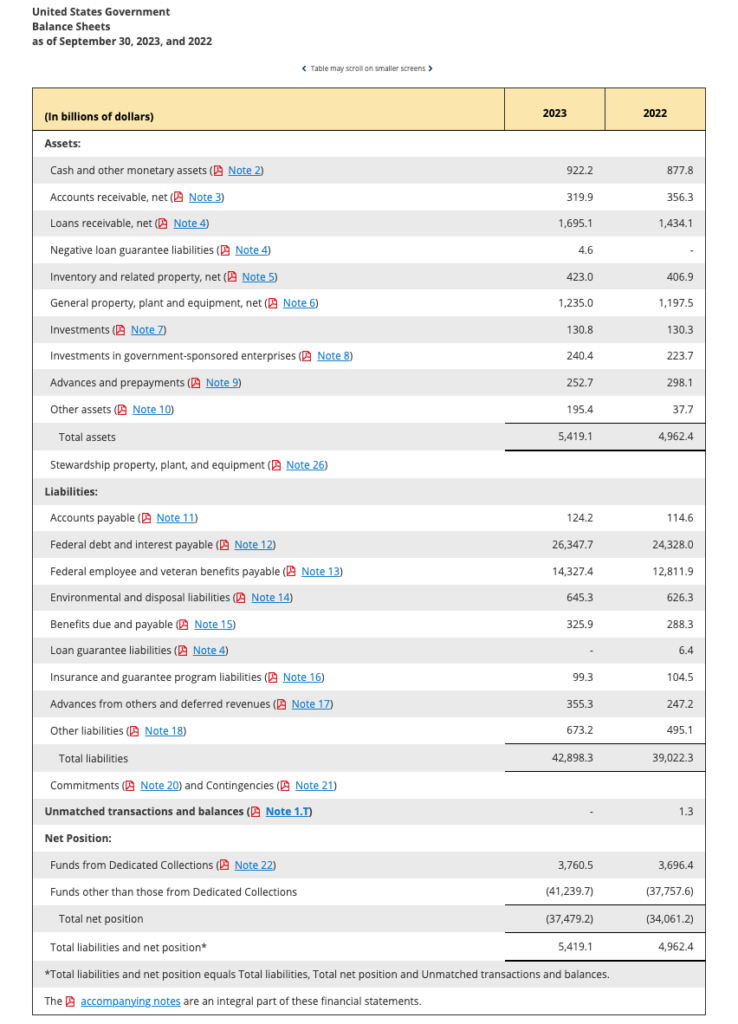

Government sector: Government often need to raise funds by borrowing. Unlike business governments cannot sell equity shares. Governments are restricted to borrowing to raise funds when tax revenues are not sufficient to cover expenditures.

Image 3: United States Government Balance Sheets as of September 30, 2023, and 2022

Source: https://fiscal.treasury.gov/

Comments