YTC Ventures Insights | Technocrat’ Magazine

November 10, 2025

In a timely warning as gold prices hover near record highs, India’s markets regulator, the Securities and Exchange Board of India (SEBI), has issued a stark advisory to investors: steer clear of “digital gold” or “e-gold” products peddled by online platforms. These convenient-sounding alternatives to physical gold, often marketed as seamless ways to buy fractional amounts starting from just ₹10, are not what they seem. According to SEBI, they operate in a regulatory black hole, exposing users to hefty counterparty and operational risks with zero safety net from the watchdog’s investor protection framework.

The alert, released on November 8, 2025, comes amid a frenzy of gold buying in India, fueled by global uncertainties, inflation hedges, and festive season demand. With spot gold prices surpassing $2,700 per ounce internationally and domestic MCX futures touching ₹78,000 per 10 grams, digital gold has exploded in popularity.

Platforms from e-commerce giants to fintech apps have raked in millions, promising “trusted” digital ownership backed by reputed names like Tanishq (powered by Tata and SafeGold) and MMTC-PAMP.

But SEBI begs to differ: these aren’t “securities” or regulated commodity derivatives – they’re unregulated wild cards.

The Digital Gold Trap: Convenience at What Cost?

Digital gold lets users buy, sell, or redeem virtual gold anytime via apps like Paytm, PhonePe, Google Pay, or jewelry brand portals. It’s pitched as a hassle-free entry into the yellow metal’s allure – no storage worries, low entry barriers, and instant liquidity.

Yet, SEBI’s circular pulls no punches: “Such digital gold products may entail significant risks for investors and may expose investors to counterparty and operational risks.” Translation? If the platform folds, the backing vault defaults, or cyber glitches strike, you’re on your own.

No SEBI redressal, no grievance mechanisms, no oversight – unlike the fortified world of stock exchanges.This isn’t SEBI’s first rodeo. Back in 2021, the regulator flagged similar concerns during a digital gold boom. Fast-forward to 2025, and the landscape has only grown murkier with more players jumping in. Reports highlight how these schemes lure millennials and first-time investors with flashy ads, but the fine print?

Buried under layers of unverified claims.Experts echo the caution. “While digital gold democratizes access, the lack of standardization and regulatory cover turns it into a gamble,” says a senior analyst at a Mumbai-based brokerage. Social media is abuzz too – X (formerly Twitter) threads are flooding with user stories of delayed redemptions and opaque fee structures, amplifying the buzz around SEBI’s wake-up call.

Safer Paths to Gold: SEBI’s Regulated Roadmap

The good news? SEBI isn’t anti-gold; it’s pro-safety. The regulator points to a trio of vetted avenues for yellow metal exposure, all tradable on stock exchanges via registered brokers:

- Gold Exchange-Traded Funds (ETFs): Mutual fund-backed baskets of physical gold, offering liquidity and diversification without the vault hassle. Popular picks include Nippon India ETF Gold BeES and HDFC Gold ETF.

- Electronic Gold Receipts (EGRs): Digital certificates representing physical gold stored in SEBI-approved vaults, redeemable for bars or coins.

- Exchange-Traded Commodity Derivatives: Futures and options on MCX, ideal for hedging or speculation under strict oversight.

These options come with the full SEBI shield: transparent pricing, intermediary accountability, and robust complaint resolution. “Investments in these SEBI-regulated gold products can be made through SEBI-registered intermediaries and are governed by the regulatory framework prescribed by SEBI,” the advisory notes. In a market where gold has returned over 25% YTD, why roll the dice on the unregulated when the house (SEBI) has your back?

YTC Ventures’ Take: Diversify Smartly in Uncertain Times

As conversations around SEBI’s warning trend on X and financial forums, YTC Ventures – a forward-thinking investment advisory firm – urges a balanced approach. “Gold’s timeless appeal as an inflation hedge is undeniable, but the digital shortcut isn’t worth the detour,” says a YTC spokesperson. Instead, we recommend:

- Prioritize Regulated ETFs for Core Exposure: Allocate 5-10% of your portfolio to SEBI-approved gold ETFs. They’re low-cost (expense ratios under 0.5%) and track spot prices faithfully – perfect for long-term wealth preservation.

- Layer in EGRs for Tangible Upside: For those craving physical gold’s tangibility, EGRs offer the best of both worlds: digital trading with redemption options. Start small via platforms like NSE or BSE.

- Blend with Broader Diversification: Don’t go all-in on gold. YTC suggests pairing it with equity mutual funds or sovereign gold bonds (SGBs) for yield. In volatile markets, a 60-40 equity-gold split has historically buffered downturns.

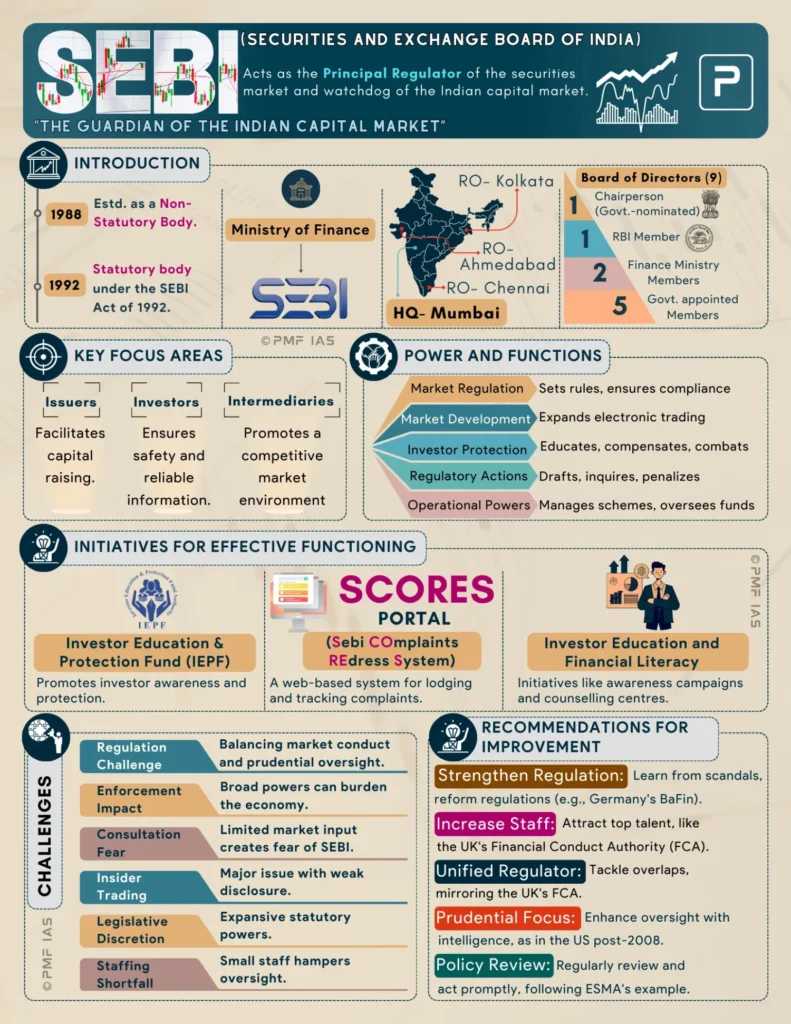

- Due Diligence First: Always verify SEBI registration on the regulator’s website before investing. Tools like the SCORES portal can flag red flags early.

YTC Ventures’ model portfolios have outperformed benchmarks by emphasizing regulated assets, helping clients navigate 2025’s gold surge without the pitfalls. Curious? Reach out for a free portfolio audit.

The Bottom Line: Caution is the New Gold Standard

SEBI’s clarion call is a reminder: in investing, convenience shouldn’t trump compliance. As digital gold’s hype collides with reality, savvy investors are pivoting to regulated rails. With global tensions simmering and rupee pressures mounting, gold remains a star – but only if you play by the rules.Stay informed, invest wisely. What’s your move in this gold game?

Share in the comments.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. YTC Ventures is not a SEBI-registered investment advisor. Always consult a qualified professional and conduct your own research before making investment decisions. Past performance is not indicative of future results.

Comments