YTC Ventures Technology Insights, Technocrat’ Magazine

October 16, 2025

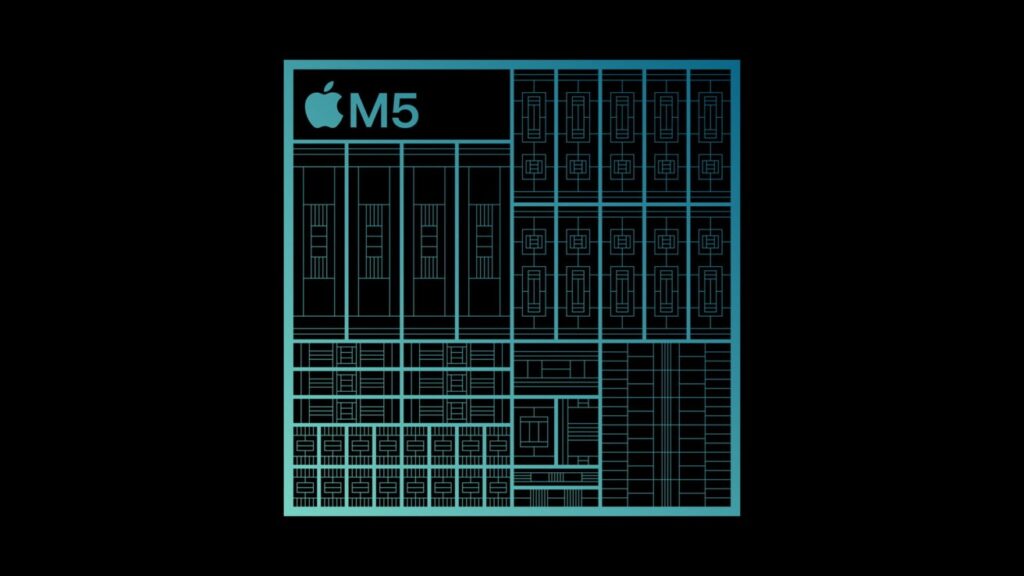

In a world where AI isn’t just a buzzword but the beating heart of innovation, Apple has once again redefined the rules. Yesterday’s announcement of the M5 chip—debuting in the refreshed 14-inch MacBook Pro, iPad Pro, and Vision Pro—marks a seismic shift. This isn’t an incremental update; it’s a bold declaration that Apple’s silicon empire is entering its AI golden age.

With over 4x the GPU compute power for AI compared to the M4, enhanced Neural Accelerators in every GPU core, and a blistering 153GB/s unified memory bandwidth (a 30% jump), the M5 isn’t just faster—it’s smarter. Imagine editing 8K video while running local LLMs for real-time script analysis, or generating photorealistic AI art on-device without a cloud whisper.

The MacBook Pro M5 starts at $1,599, delivering 24 hours of battery life and pro workflows that feel effortless. Social media is ablaze: X users are hailing it as “insanely great” for creators, with one viral post calling it “the iPhone moment for AI laptops.” Pre-orders are live, and if history is any guide, stock will vanish faster than a Black Friday iPhone line. But why now?

As competitors like Qualcomm’s Snapdragon X Elite and Intel’s Lunar Lake scramble to catch up, Apple’s vertical integration—custom silicon, optimized software, and privacy-first AI—gives it an unassailable edge. The M5 powers Apple Intelligence features like on-device text-to-image generation in apps such as Draw Things, and accelerates deep learning in tools like Final Cut Pro.

It’s not hype; it’s hardware that anticipates your next move. Critics might nitpick the lack of design overhauls (no OLED yet—that’s for M6 in 2027), but for pros and power users, this is the upgrade path to tomorrow. If you’re still on M1 or older, the M5 MacBook is your ticket to the future. Apple didn’t just launch a chip; they launched an era. Who’s ready to leap?

MacBook M5 Competitors: A Quick Comparison Table

The MacBook Pro M5 enters a crowded field of premium laptops, where AI prowess and portability reign supreme. Here’s how it stacks up against key rivals in 2025, based on base configurations for 14-16 inch models suitable for pro workflows. Prices reflect U.S. starting MSRPs; actual costs vary with upgrades.

| Competitor Model | Key Chip/Processor | AI/Graphics Highlights | Battery Life (Claimed) | Starting Price Range | Strengths vs. M5 MacBook Pro |

|---|---|---|---|---|---|

| Apple MacBook Pro 14″ (M5) | Apple M5 (10-core CPU, 10-core GPU) | 4x AI GPU compute vs. M4; 16-core Neural Engine | Up to 24 hours | $1,599 – $2,499 | Best-in-class efficiency, ecosystem integration |

| Dell XPS 14 | Intel Core Ultra 9 285H | NPU for Copilot+ AI; RTX 4050 optional | Up to 18 hours | $1,499 – $2,299 | More ports (Thunderbolt 4×2); customizable Windows apps |

| HP Spectre x360 14 | Intel Core Ultra 7 258V | Arc graphics with AI acceleration | Up to 17 hours | $1,299 – $1,999 | 2-in-1 convertible; haptic touchpad |

| Lenovo Yoga Pro 9i (16″) | Intel Core Ultra 9 + RTX 4060 | Dedicated NPU for local AI; Mini-LED display | Up to 14 hours | $1,699 – $2,499 | Superior color accuracy for creators; haptic dial |

| Razer Blade 14 | AMD Ryzen AI 9 HX 370 + RTX 4070 | AMD XDNA 2 NPU; gaming-grade GPU | Up to 10 hours | $2,199 – $2,999 | Discrete NVIDIA GPU for heavy rendering; premium aluminum |

| Microsoft Surface Laptop 7 (15″) | Qualcomm Snapdragon X Elite | 45 TOPS NPU for on-device AI | Up to 20 hours | $1,299 – $2,099 | ARM efficiency rivals Apple; seamless Copilot integration |

The M5 edges out in battery and seamless AI (e.g., running LLMs 50% faster than M4), but Windows alternatives shine in expandability and gaming.

The R&D Cost of Crafting the M5: Billions in the Bank for Silicon Dreams

Apple doesn’t disclose per-chip R&D costs—trade secrets are sacred—but piecing together financials paints a clear picture. In fiscal 2024 (ending September 2024), Apple poured $31.37 billion into R&D, a 4.86% YoY increase from $29.915B in 2023.

This surge funds everything from silicon design to AI neural engines, with the M-series transition (M1 to M5) as a cornerstone. Since 2020, cumulative R&D has topped $150B, per MacroTrends data.

The M5 specifically leverages TSMC’s advanced 3nm N3P process and Apple’s SoIC (System-on-Integrated-Chips) packaging, innovations born from years of collaboration. Analysts estimate $5-10B for the M5 family alone, including prototyping and testing—peanuts for a company eyeing $394B in FY2024 revenue.

It’s an investment yielding 30%+ gross margins, proving Apple’s mantra: Spend big on brains, reap efficiency forever.

Why the M5 is Better: A Technical Deep Dive for Technorati Magazine

In the relentless pursuit of computational transcendence, Apple’s M5 chip emerges not as evolution, but revolution.

Fabricated on TSMC’s third-gen 3nm node, the M5 integrates a 10-core CPU (4 performance + 6 efficiency cores), a next-gen 10-core GPU, and a 16-core Neural Engine clocked for 38 TOPS—delivering 3.5x AI performance over M4 and 5.6x over M1.

GPU Neural Accelerators: AI’s New Frontier

Each GPU core now embeds a dedicated Neural Accelerator, enabling matrix multiplications for transformer models directly in silicon. This slashes latency for on-device inference—think Stable Diffusion generating 1024×1024 images in seconds, versus minutes on M4.

Ray-tracing (3rd-gen engine) and dynamic caching (2nd-gen) boost graphics by 45%, ideal for Metal-accelerated ML in apps like LM Studio.

Memory Bandwidth: The Unsung Hero

153GB/s unified LPDDR5X bandwidth (up 30% from M4’s 120GB/s) feeds voracious AI workloads.

For diffusion models or LLMs up to 70B parameters, this means 2x faster token generation without thermal throttling. Efficiency cores sip power at 3nm, yielding 24-hour MacBook battery—proving Apple’s fanless designs scale.

Edge Over Rivals

Versus Snapdragon X Elite (45 TOPS NPU but fragmented ecosystem), M5’s unified memory architecture (UMA) enables seamless CPU/GPU/Neural Engine handoffs, reducing overhead by 20-30% in benchmarks. SoIC packaging stacks dies vertically, cutting leakage and heat—critical for sustained 100W+ loads in Vision Pro. Downsides? Base M5 skips Pro/Max variants (those hit 2026), and Wi-Fi 6E lags 7.

Yet for devs, the M5’s MLX framework integration heralds a golden era of local AI. As one X engineer quipped: “M5 isn’t catching up—it’s lapping the field.Verdict: If M4 was the spark, M5 is the inferno.

A Short Journey Through Apple’s CEO Legacy: Visionaries, Turnarounds, and Trillion-Dollar Empires

Apple’s leadership saga is a rollercoaster of garage dreams and boardroom battles, each CEO etching their mark on a company now worth $3.5T.

- Steve Jobs (Co-founder/CEO 1976-1985, iCEO/CEO 1997-2011): The visionary. Launched Apple I/II, Macintosh (1984), iMac (1998), iPod (2001), iTunes, iPhone (2007), iPad (2010). Turned $309M profit in his first full year back (1998) from near-bankruptcy. Revenue: Grew from $7B (1997) to $108B (2011). Services like App Store revolutionized ecosystems.

- Tim Cook (CEO 2011-present): The executor. Oversaw Apple Watch (2015), AirPods (2016), Apple TV+, and Apple Silicon shift (M1 2020). Doubled revenue/profit by 2020; market cap from $348B to $1.9T. Revenue: Exploded to $394B (FY2024). Privacy focus and supply chain mastery defined his era.

- Interim/Predecessors: Michael Scott (1977-1981): Built ops for Apple II boom ($150M revenue). John Sculley (1983-1993): Marketing whiz behind Mac, but clashes with Jobs led to ouster; revenue hit $8B peak but profits tanked. Michael Spindler (1993-1996): Stabilized amid PC wars. Gil Amelio (1996-1997): Acquired NeXT, paving Jobs’ return; revenue dipped to $7B.

From Wozniak’s circuits to Cook’s clouds, each built the next layer.

Revenues Crown the Kings: Tim Cook’s Unrivaled Profit Throne

Adjusted for tenure and inflation, Tim Cook reigns supreme in profitability. Under Jobs (1997-2011), annual revenue averaged ~$40B, peaking at $108B with 25% margins—iconic but volatile. Cook (2011-2025) averaged $300B+ annually, with FY2024 at $394B and $97B net profit (24.6% margin).

Cumulative: Cook’s era generated $3T+ revenue vs. Jobs’ $500B revival. Sculley/Spindler/Amelio eras? Losses dominated, with revenues stagnant at $5-10B. Cook’s services pivot (now 22% of revenue) and silicon bets sealed his legacy as Apple’s most lucrative steward.

Industry Echoes: M5’s Ripple Effect

The M5 rollout has tech titans buzzing—and scrambling. Reuters calls it a “clear message to rivals” like Qualcomm/Intel, whose AI chips lag in efficiency.

X threads explode with praise: “M5 Pro/Max will crush NVIDIA for local AI,” per devs, while leaks show 15% CPU/36% GPU uplifts. @Sankew06

Critics note no Wi-Fi 7 or charger in EU boxes, sparking “greenwashing” gripes.@shiftdeletenet

Overall? Ecstatic—Apple’s “personal intelligence” vision has analysts forecasting 20% Mac growth in 2026.

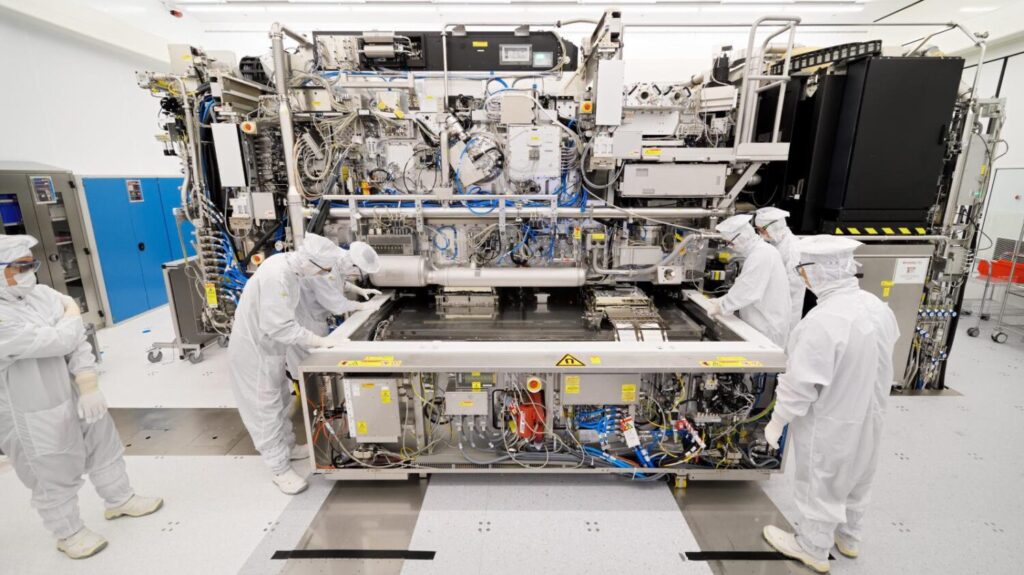

Forged in Taiwan: Where the M5 Chip is Born

The M5’s silicon soul is etched at TSMC’s fabs in Taiwan, using the cutting-edge 3nm N3P process for density and power savings.

Packaging follows via OSAT partners like ASE (Taiwan), Amkor (U.S.), and JCET (China). High-end M5 Pro/Max/Ultra variants will ramp in TSMC’s Arizona plant by late 2025, with Apple’s new Houston server factory (opening 2026) assembling AI rigs.

This diversification counters geopolitical risks, blending Eastern precision with Western scale.

Comments