By YTC Ventures Technology Desk | October 6, 2025

In the high-stakes arena of global technology, few companies wield as much influence as Taiwan Semiconductor Manufacturing Company (TSMC). As the world’s largest dedicated semiconductor foundry, TSMC doesn’t just make chips—it fabricates the future. From the AI accelerators in Nvidia’s GPUs to the processors powering Apple’s iPhones, TSMC’s silicon wafers are the unseen force behind everything from smartphones to fighter jets. But as AI demand skyrockets and geopolitical fault lines deepen, TSMC stands at the epicenter of a perfect storm.

This article dives into its origins, Taiwan’s semiconductor supremacy, the company’s explosive growth, and the ripple effects across the globe—from U.S. tariffs to Europe’s chip ambitions and India’s rising ambitions.

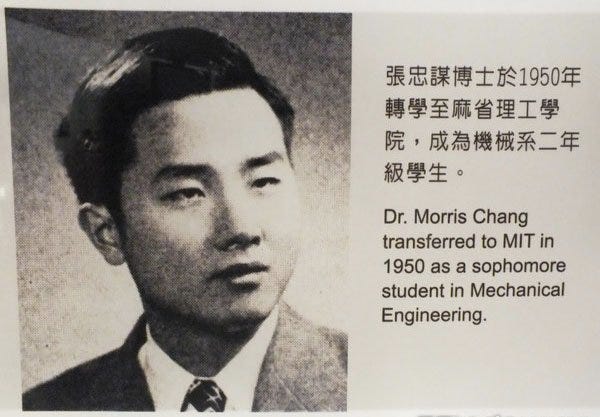

The Visionary Founder: Morris Chang’s Semiconductor Revolution

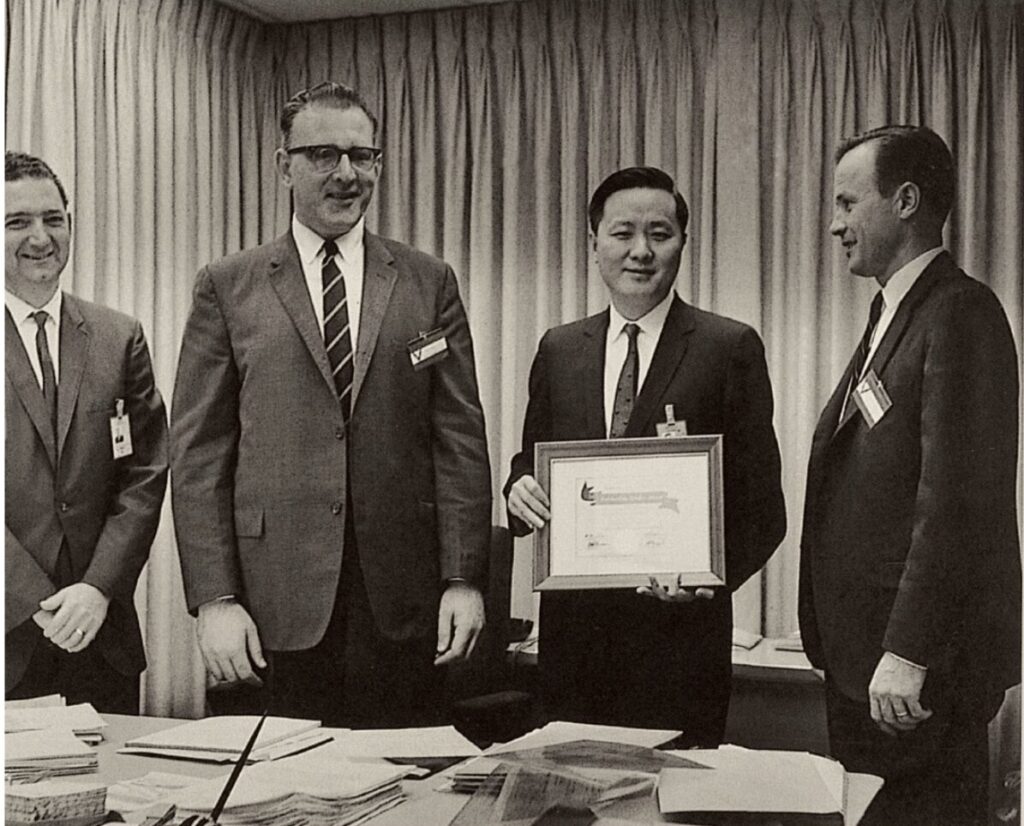

TSMC’s story begins with Morris Chang, a Chinese-born engineer whose life reads like a Silicon Valley thriller. Born in 1931 in Ningbo, China, Chang fled to Taiwan as a child amid civil war, then emigrated to the U.S. in 1949. He earned degrees from MIT and Stanford, rising through the ranks at Texas Instruments (TI) to become its youngest vice president by 1967.

At TI, Chang honed his expertise in semiconductors, but by the 1980s, he saw the industry’s future: specialization.Frustrated by U.S. firms’ reluctance to outsource manufacturing, Chang returned to Taiwan in 1985 as head of the Industrial Technology Research Institute (ITRI). In 1987, with government backing and a pivotal partnership with Philips (which provided technology in exchange for equity), he founded TSMC. The revolutionary “pure-play foundry” model—manufacturing chips designed by others without competing in design—transformed the industry.

Chang served as CEO until 2005 and chairman until 2018, turning TSMC into Taiwan’s most valuable company and a $1 trillion behemoth. Today, at 94, Chang is hailed as the “father of the semiconductor foundry,” with his net worth exceeding $7 billion.Chang’s insight was simple yet profound: as electronics firms focused on innovation, they needed a neutral, high-volume manufacturer. TSMC’s early clients included Broadcom and Qualcomm, fueling the fabless revolution. Under Chang, TSMC pioneered nodes down to 7nm, but his legacy endures in the company’s culture of relentless execution.

Why Taiwan Dominates the Silicon Wafer Game

Taiwan’s ascent to semiconductor supremacy is no accident—it’s a masterclass in strategic policy, talent cultivation, and ecosystem building. Starting in the 1970s, amid an oil crisis that crippled its export-dependent economy, Taiwan’s government launched a national plan to pivot to high-tech. The Industrial Technology Research Institute (ITRI) was key, securing technology transfers from RCA in 1976 to build its first 3-inch wafer fab in 1977. This spawned United Microelectronics Corporation (UMC) in 1980 and TSMC in 1987.Several factors fueled this rise:

- Government Vision and Subsidies: Taiwan invested heavily in R&D, offering low-interest loans and tax breaks. By the 1990s, it subsidized 50% of fab costs, attracting foreign tech while nurturing locals.

- Talent Pipeline: Ties to Silicon Valley drew back U.S.-trained engineers. Taiwan’s universities, like National Tsing Hua, produce 20,000 semiconductor specialists annually. Chang himself bridged both worlds.

- The Foundry Model: TSMC’s innovation separated design from fabrication, lowering barriers for startups like Nvidia. Today, TSMC holds 62% of the global foundry market.

- Complete Supply Chain: From wafer production (GlobalWafers) to packaging (ASE), Taiwan controls 75% of advanced wafer capacity. This “silicon shield” deters aggression, as disrupting it would cripple global tech.

By 2025, semiconductors account for 15% of Taiwan’s GDP, with TSMC alone contributing $90 billion in revenue. Yet, this dominance amplifies vulnerabilities—Taiwan produces 92% of the world’s advanced logic chips.

Geopolitical Chess: TSMC as the World’s Silicon Shield

TSMC isn’t just a company; it’s a geopolitical linchpin. Producing 90% of advanced chips, it powers U.S. defense (F-35 jets), consumer tech (iPhones), and AI (Nvidia GPUs). This creates a “silicon shield”: any Chinese move on Taiwan risks a $10 trillion global economic hit, per estimates.

Tensions escalated post-2020. U.S.-China trade wars led to Huawei bans, forcing TSMC to halt advanced shipments to China in 2020. The 2022 CHIPS Act poured $52 billion into U.S. fabs, pressuring TSMC to invest $65 billion in Arizona (now $165 billion total, including three new fabs by 2030). Europe followed with its €43 billion Chips Act, luring TSMC’s €10 billion Dresden fab with subsidies.China, spending $150 billion on semiconductors, lags at 7nm due to U.S. export controls on ASML tools.

A Taiwan conflict could trigger U.S.-Japan sanctions, halting EUV lithography. Yet, TSMC’s diversification—10% of capacity abroad by 2025—mitigates risks without eroding Taiwan’s edge.As U.S. Treasury Secretary Scott Bessent warned, “99% of high-performance chips from Taiwan is the world’s single greatest point of failure.” TSMC’s neutrality keeps it thriving, but tariffs (up to 25% proposed by Trump) could hike prices 10% in 2026.

TSMC’s Investment Surge: A Global Bet on Resilience

Geopolitics and AI have supercharged TSMC’s capex.

From $30 billion in 2020, it hit $30 billion annually by 2024, with $20.7 billion approved in August 2025 alone for advanced nodes and packaging.

| Year | Investor/Partner | Investment Amount (USD) | Location/Details | Citation |

|---|---|---|---|---|

| 2020 | TSMC (self) + U.S. CHIPS Act subsidy | $12B initial (now $165B total) | Arizona, USA: Three fabs, R&D center; $6.6B direct funding + $5B loans | , |

| 2021 | Sony + TSMC | $7B | Kumamoto, Japan (JASM): 22/28nm processes; Sony 6% stake | |

| 2022 | Denso + Toyota + TSMC/Sony | $0.35B (Denso stake) | Kumamoto expansion: 12/16nm; total >$20B | |

| 2023 | EU Chips Act (Germany) | $3.8B (70% TSMC stake) | Dresden, Germany: First EU fab; €5B state aid | , |

| 2024 | TSMC (self) + U.S. CHIPS | $65B (Arizona expansion) | Phoenix: 4nm production; up to 25% tax credits | |

| 2025 | TSMC (self) + U.S. (additional) | $100B | Arizona: Three new fabs, packaging; total U.S. $165B | , |

| 2025 | TSMC Global Ltd. | $10B | British Virgin Islands: General investments |

These moves, backed by $10B+ in subsidies, aim for 50% non-Taiwan capacity by 2030, creating 100,000+ jobs.

Revenue Rocket: AI Fuels Record Growth

TSMC’s finances mirror its dominance. AI chips drove 74% of Q2 2025 revenue from advanced nodes.

| Year | Revenue (USD Billions) | YoY Growth | Key Driver |

|---|---|---|---|

| 2020 | $45.5 | +13% | COVID recovery, 5nm ramp-up |

| 2021 | $57.2 | +26% | Smartphone boom, 3nm debut |

| 2022 | $75.9 | +33% | AI initial surge, despite slowdown |

| 2023 | $69.3 | -9% | Inventory glut, but AI rebound |

| 2024 | $88.3 | +27% | AI dominance; record $90B NT$ equiv. |

Through August 2025, revenue hit $80.3B (+37% YoY), with August alone at $11.1B.

@StockMKTNewz Projections: $100B+ in 2025, margins at 42.5%.

EU Chips Act: A Mixed Bag for TSMC

The EU’s €43B Chips Act aims for 20% global share by 2030 (from 10%). It lured TSMC’s Dresden fab, boosting Europe’s auto supply chain. Yet, shortfalls loom: EU production may rise just 6%, far from sovereignty. TSMC benefits from subsidies but faces delays in talent and infrastructure. Critics call it “Chips Act 2.0” needed to quadruple spending.

India’s Semiconductor Ambitions: Partnerships Over Rivals

India’s $10B Semicon India Program targets $110B market by 2030. No direct TSMC fab yet, but Tata-Powerchip JV ($11B, Dholera) and HCL-Foxconn ($0.45B, Uttar Pradesh) eye 2026 production.

TSMC eyes rare earths for EVs/defense in exchange for investments. With 10 approved projects ($18B total), India leverages neutrality for neutral supply chains.

Trending Now: TSMC’s AI Juggernaut and Tariff Turbulence

X is ablaze with TSMC buzz: AI chip hikes (up 10% for 2nm), Apple’s 50%+ booking of 2026 capacity, and Nvidia’s Rubin tape-outs on TSMC’s 3nm. Environmental concerns in Kumamoto (#TSMCPollution) clash with optimism: “TSMC’s 70% market share is unbeatable.”

@Jukanlosreve U.S. revokes China waivers, funneling demand to allies.

@StockSavvyShay As one post quips: “TSMC: Monopoly with pricing power.”

@DividendDude_XTSMC’s trajectory? Unstoppable, but precarious. In a world racing for chip autonomy, it remains the indispensable force—until someone cracks the code. What’s your take: Bullish on TSMC, or time to diversify?

Comments