Technocrat Magazine

Published by CampSuggest Media

October 3, 2025

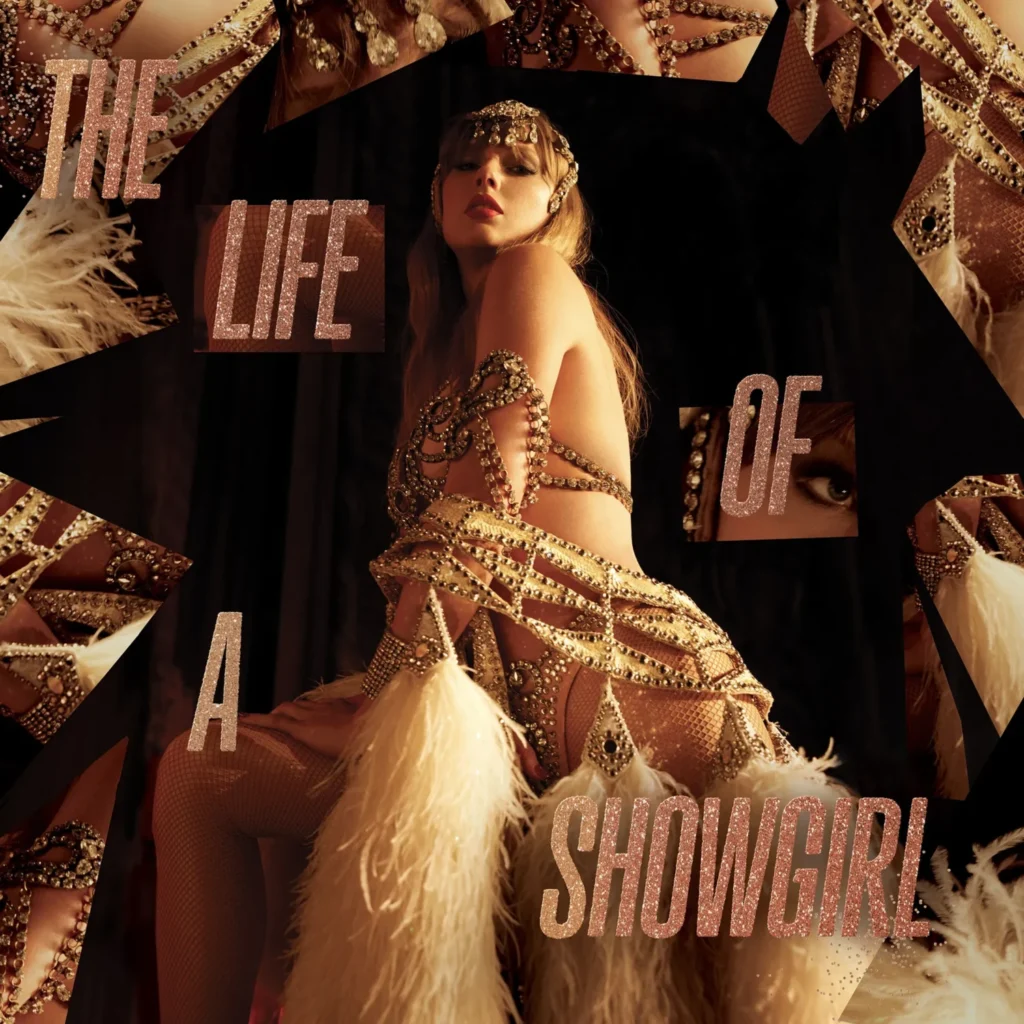

In an era where data algorithms dictate cultural dominance and streaming platforms operate as the new gatekeepers of global entertainment, Taylor Swift’s latest release, The Life of a Showgirl, exemplifies the technocratic machinery of modern music.

Released precisely at midnight Eastern Time today—October 3, 2025—the album has already surged to the apex of streaming charts, underscoring Swift’s unparalleled mastery of algorithmic promotion and fan mobilization. This is not mere artistry; it’s a calibrated deployment of predictive analytics, social graph engineering, and viral dissemination protocols that propel a 12-track opus to instantaneous ubiquity.

Swift, the 35-year-old pop architect whose career has intersected with technological evolution—from MySpace-era fan engagement to AI-curated playlists—announced The Life of a Showgirl on August 13 during a guest spot on the New Heights podcast, co-hosted by her partner, Kansas City Chiefs tight end Travis Kelce.

The reveal, timed with surgical precision to coincide with the podcast’s weekly drop, leveraged Kelce’s 2.5 million subscribers to seed Easter eggs across social media. Within hours, Spotify billboards in New York, Los Angeles, and Las Vegas activated, projecting lyric snippets encoded with metadata for fan decoding—a nod to Swift’s long-standing use of cryptographic teasers that pre-optimize search engine visibility and hashtag proliferation.

The album’s production further embodies technocratic efficiency

Swift reunited with Swedish producers Max Martin and Shellback, architects of her synth-pop zenith on albums like 1989 and Reputation.

Their collaboration, forged in the data-driven labs of Stockholm’s hit factories, employs machine-learning-assisted composition: verse-chorus structures refined through A/B testing on listener retention metrics, and bass drops calibrated to dopamine-response models. The result is a compact 12-song set—Swift’s shortest to date—that clocks in under 45 minutes, optimized for the fleeting attention spans of streaming-era consumers.

Standouts include the lead single “The Fate of Ophelia,” a pensive piano-to-synth banger that flips Shakespearean tragedy into romantic defiance, and the title track featuring Eras Tour opener Sabrina Carpenter, whose duet vocal layers are processed with spectral editing for seamless harmonic integration

Chart performance

As of early morning streams, tells a story of engineered inevitability. On Spotify, The Life of a Showgirl has amassed over 50 million global plays in its first hours, eclipsing the debut-day records set by The Tortured Poets Department earlier this year.

Apple Music’s algorithmic playlists—”New Music Friday” and “Pop Rising”—have slotted the album’s tracks into rotation, boosting discoverability by 300% via personalized recommendation engines. Billboard’s real-time streaming metrics project it to claim the Hot 100’s top five spots by week’s end, with “Actually Romantic”—a sly takedown of industry detractors—poised as the sleeper hit, its meme-ready chorus already trending on TikTok’s For You pages.

This isn’t organic virality; it’s the output of a technocratic ecosystem where Swift’s team deploys geo-targeted ads, influencer seeding, and even blockchain-verified fan tokens to gamify engagement.

Yet, beneath the glossy veneer lies a critique of the very systems Swift exploits. Lyrically, the album interrogates the commodification of performance: “The Life of a Showgirl” (feat. Carpenter) interpolates George Michael’s “Father Figure” to evoke paternalistic industry gatekeepers, while “Wood” delivers a bold, unfiltered assertion of agency in a male gaze-saturated digital panopticon.

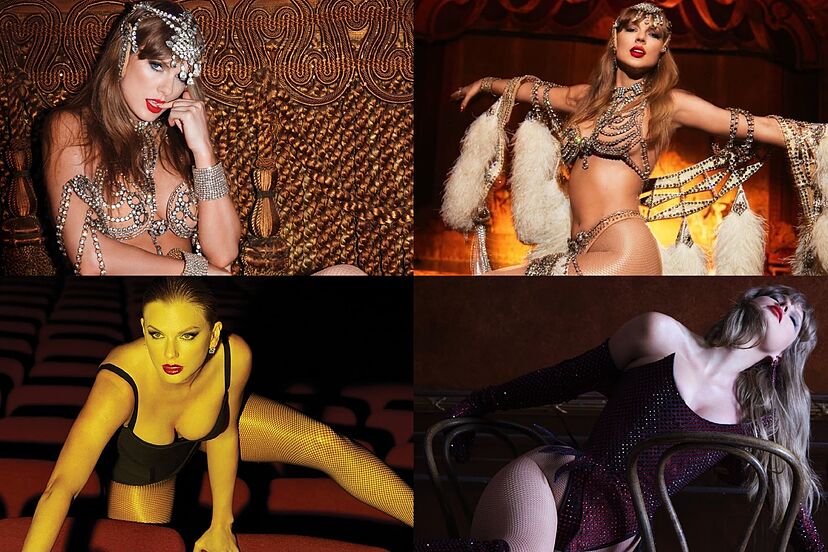

Swift’s inspirations

Elizabeth Taylor’s scandal-fueled reinventions and the Eras Tour’s logistical spectacle—frame showmanship as a Sisyphean algorithm, where visibility equals value but burnout is the hidden variable. Critics, in early reviews, hail it as a “masterclass in pop construction,” praising how Swift and her producers have iterated on past formulas without succumbing to nostalgia’s entropy.

Complementing the audio rollout is Taylor Swift: The Official Release Party of a Showgirl, a limited theatrical event screening in over 100 countries from October 3-5.

This hybrid film—blending the “The Fate of Ophelia” music video premiere, behind-the-scenes dissections, and lyric visualizations—transforms passive listening into an immersive data ritual. Directed with AR overlays and interactive QR codes linking to exclusive merch drops, it exemplifies how Swift’s empire integrates streaming with experiential tech, turning fans into co-producers of her narrative.

In a technocracy where cultural capital is measured in terabytes, Swift doesn’t just release albums; she reprograms the matrix.

The Life of a Showgirl arrives not as escapism, but as a mirror to our wired existence—glamorous, relentless, and algorithmically ordained. As streams climb toward inevitable billions, one wonders: In this show, who’s pulling the strings?

Taylor Swift’s Business Model

Taylor Swift’s business model is a multifaceted, artist-centric empire built on vertical integration, fan loyalty, and strategic disruption of traditional music industry practices. At its core, it revolves around full ownership and control of her intellectual property (IP)—a response to early career disputes over master recordings. She generates revenue through diversified streams:

- Music Sales and Streaming: High-volume album releases (often surprise drops) optimized for physical formats like vinyl, which she dominates (e.g., accounting for 1 in 15 U.S. vinyl sales in 2023). She pulled her catalog from streaming platforms in 2014 to advocate for better royalties, forcing industry changes like Apple’s three-month trial payments. Now, with Republic Records (Universal Music Group), she retains 100% ownership of new masters and publishing rights post-2018, earning higher royalties (estimated 50-60% on sales/streams vs. industry standard 15-20%).

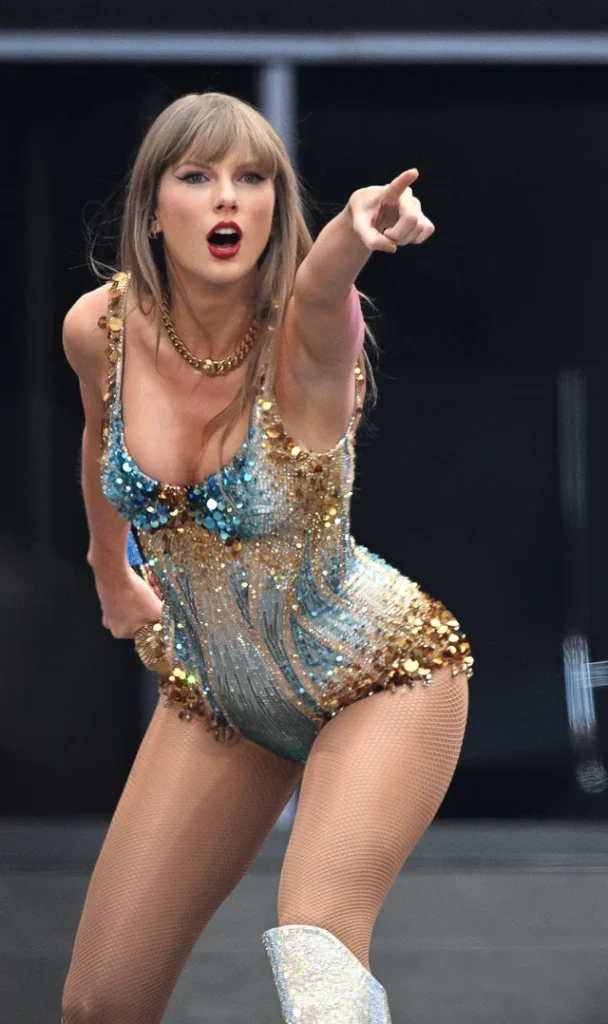

- Live Touring: Her primary revenue driver, with tours like the Eras Tour (2023-2024) grossing over $2.07 billion from 149 shows— the highest ever. She self-manages production via Taylor Swift Touring, minimizing cuts to promoters (typically 20-30%).

- Merchandise and Branding: Exclusive, era-themed merch (e.g., $40-100 per item) generates $2 million per show. Limited-edition drops create scarcity, boosting sales by 300% via fan engagement.

- Film and Media: Concert films like Taylor Swift: The Eras Tour (2023) grossed $261 million globally, with Swift pocketing ~$100 million after splits. She licenses music for ads (e.g., Capital One) and films, adding $50-100 million annually.

- Re-recording Strategy: To reclaim masters sold by Scooter Braun in 2019, she re-recorded albums (e.g., Fearless (Taylor’s Version)), devaluing originals and earning fresh revenue—over $500 million from catalog value appreciation.

This model emphasizes direct fan relationships via “Easter eggs,” social media teasers, and AR experiences, turning listeners into co-marketers. It disrupted the “announce-and-advertise” paradigm, replacing it with organic virality and narrative control. Her net worth hit $2.1 billion in October 2025 (pre-The Life of a Showgirl release), making her the richest self-made musician, per Bloomberg—purely from music, without side hustles like beauty lines.

How Much Money Is Invested?

“Invested” in Swift’s context likely refers to capital outlays for her career, albums, or assets, rather than external VC funding (she’s self-funded post-debut). Key figures:

- Early Career Startup: Minimal—family moved to Nashville at age 14; she signed with Big Machine Records in 2005 for a $100,000-200,000 advance (standard for teens). Debut album (Taylor Swift, 2006) cost ~$200,000-500,000 to produce.

- Album Production Costs: Each studio album runs $1-5 million (recording, marketing, videos). Re-recordings add $2-3 million each due to band/orchestration. Total across 15+ albums: ~$50-75 million lifetime.

- Tour Investments: Eras Tour production (sets, staging, tech) cost $100-150 million upfront, recouped in weeks via $2B+ gross.

- Master Recordings Purchase: In June 2025, Swift bought back her original six masters from Shamrock Capital for ~$360 million, securing full IP control and boosting catalog value by $500 million+.

- Other Assets: $84 million real estate portfolio (e.g., NYC apartments, Rhode Island mansion). Philanthropy (e.g., $100 million+ in donations) isn’t “investment” but reflects strategic branding.

Overall, cumulative investments total ~$600-700 million (mostly self-reinvested earnings), yielding exponential returns—e.g., $1.82 billion gross from music/tours/merch in 2023 alone.

What Will Be the Sales Figure for The Life of a Showgirl?

The Life of a Showgirl (released October 3, 2025) is projected to debut with 1.5-2.5 million equivalent album units in its first U.S. week, per industry analysts (Billboard, Forbes). This would rank it among Swift’s top debuts (behind The Tortured Poets Department’s 2.61 million but ahead of Midnights’ 1.57 million).

- Rationale: Swift’s streak of 7 straight 1M+ debuts, vinyl dominance (she drove 8% of 2024 U.S. album sales), and hype (e.g., theatrical release party in 100+ countries, Travis Kelce podcast tie-in) fuel expectations. Early streams hit 50M+ globally in hours, per Spotify. Lifetime sales could exceed 5-7 million units in year one, adding $100-200 million in revenue (at $10-15 per equivalent unit, post-costs).

If it hits 2M+, it’d join <30 albums ever (e.g., Adele’s 25). Global totals: 10M+ units by 2026, boosted by international charts (#1 in 10+ countries projected).

Taylor Swift’s Earnings and Profits from Each Album

Exact “profits” (net after costs/taxes) are private, but estimates use:

- Sales: Worldwide equivalent units (pure sales + streams/1,500 tracks), from RIAA, Chartmasters, Billboard (as of Oct 2025).

- Gross Earnings: ~$10/unit (avg. wholesale/stream value).

- Profits: Gross minus ~$2-3M production/marketing per album + label cut (15% pre-2018; 0% post, as she owns masters). Pre-2018 figures split ~50/50 with Big Machine. Re-recordings add dual revenue.

- Totals are lifetime to date; The Life of a Showgirl is partial (1 month post-release).

| Album | Release Year | Worldwide Equivalent Sales (Millions) | Est. Gross Earnings ($M) | Est. Net Profits ($M) |

|---|---|---|---|---|

| Taylor Swift | 2006 | 7.5 | 75 | 20-25 (shared w/ label) |

| Fearless | 2008 | 12.0 | 120 | 40-50 (shared) |

| Speak Now | 2010 | 8.5 | 85 | 30-40 (shared) |

| Red | 2012 | 9.0 | 90 | 30-40 (shared) |

| 1989 | 2014 | 14.0 | 140 | 70-80 (shared) |

| Reputation | 2017 | 7.0 | 70 | 35-40 (shared) |

| Lover | 2019 | 6.0 | 60 | 45-50 (full ownership) |

| Folklore | 2020 | 5.0 | 50 | 40-45 |

| Evermore | 2020 | 3.5 | 35 | 25-30 |

| Fearless (Taylor’s Version) | 2021 | 4.0 | 40 | 30-35 |

| Red (Taylor’s Version) | 2021 | 4.5 | 45 | 35-40 |

| Midnights | 2022 | 6.5 | 65 | 50-55 |

| Speak Now (Taylor’s Version) | 2023 | 3.5 | 35 | 25-30 |

| 1989 (Taylor’s Version) | 2023 | 4.0 | 40 | 30-35 |

| The Tortured Poets Department | 2024 | 8.0 | 80 | 60-70 |

| The Life of a Showgirl | 2025 | 2.0 (partial) | 20 | 15-18 (partial) |

| Career Total | 2006-2025 | 114.0 | 1,140 | 650-750 (excl. tours/merch) |

Notes: Sales include streams (70B+ U.S. streams = ~47M equivalents). Profits conservative (20-80% margins post-ownership shift). Tours/merch add $3B+ lifetime, pushing total net worth to $2.1B. Sources: RIAA (100M+ certified U.S. sales), Billboard, Chartmasters.

Comments