On September 3, 2025, Beijing’s Tiananmen Square hosted a massive military parade to commemorate the 80th anniversary of Japan’s surrender in World War II, dubbed the “Victory Day” parade. Presided over by President Xi Jinping, the event was a bold display of China’s military advancements, geopolitical ambitions, and a message of deterrence to the United States and its allies.

The parade featured cutting-edge weapons, a complete nuclear triad, and advanced drone warfare systems, signaling China’s intent to reshape the global order. This article explores the parade’s highlights, China’s defense investments over the past decade, Asia’s top defense budgets, the impact on India, and why China may hold a long-term strategic advantage.

The 2025 Victory Day Parade: A Global Statement

The parade, one of China’s largest ever, involved over 10,000 troops, more than 100 aircraft, and hundreds of ground vehicles, including advanced weaponry displayed publicly for the first time. Attended by leaders from Russia (Vladimir Putin), North Korea (Kim Jong Un), Iran, Myanmar, and others, but shunned by Western nations like the US, Japan, and India, the event underscored Xi’s vision of a new world order challenging US-led dominance. The presence of sanctioned leaders highlighted a so-called “Axis of Upheaval,” with China positioning itself as a guarantor of peace for nations skeptical of Western influence.

Xi’s speech emphasized a choice between “peace and war,” calling for the eradication of war’s roots while showcasing weapons designed to project power, particularly over Taiwan, which China claims as its territory.

The parade’s choreography, with 50,000 vetted spectators and 85 million livestream viewers on Weibo, reflected intense patriotism, though dissent was censored.

Weapons Developed by China

The parade unveiled a range of advanced weaponry, showcasing China’s technological prowess and its ability to produce high-tech arms at scale. Key systems included:

- Nuclear-Capable Missiles:

- Dongfeng-61 (DF-61): A new road-mobile intercontinental ballistic missile (ICBM) capable of carrying multiple warheads, with a range exceeding 12,000 km, able to strike the continental US.

- Dongfeng-5C (DF-5C): An upgraded liquid-fueled ICBM with a 20,000 km range, described as having “global strike coverage,” possibly a space-transiting fractional orbital bombardment system to counter US missile defenses.

- Dongfeng-31BJ: A silo-based ICBM with a range of over 11,000 km, designed for second-strike capabilities in nuclear conflicts.

- Jinglei-1 (JL-1): China’s first air-launched nuclear missile, displayed on a military truck, completing the nuclear triad.

- Julang-3 (JL-3): A submarine-launched ICBM deployed on Type 096 submarines, enhancing China’s sea-based nuclear deterrence.

- Hypersonic Missiles:

- YJ-15, YJ-17, YJ-19, YJ-20: Hypersonic anti-ship missiles designed to neutralize US aircraft carriers and warships, with unpredictable trajectories to evade defenses. The YJ-19 is powered by a scramjet engine.

- Dongfeng-26D (“Guam Killer”): An intermediate-range missile targeting US bases in Guam, with a 14,000 km range.

- Conventional and Directed-Energy Weapons:

- Type 100 Tank: Equipped with a 105-mm gun, air defenses, and reconnaissance drones, designed to counter drone attacks seen in Ukraine.

- LY-1 Shipborne Laser Weapon: A naval air defense laser to counter drones, complementing ground-based laser systems.

- HQ-29 Space Defense System: A missile capable of destroying foreign satellites, enhancing China’s space warfare capabilities.

- J-35 Stealth Fighter: A carrier-based jet resembling the US F-35, showcasing China’s advancements in stealth aviation.

- J-15D-T: A new carrier-based electronic warfare jet, acting as a decoy and support system for fighter jets.

- Drone Warfare Systems (detailed below): The parade highlighted China’s leadership in unmanned systems, from air to sea, designed for “intelligentized warfare.”

China’s Nuclear Triad

China’s parade marked the first public display of its complete nuclear triad—land, sea, and air-based nuclear weapons—joining an elite group including the US, Russia, India, and possibly Israel. Key components include:

- Land-Based: The DF-61, DF-31BJ, and DF-5C ICBMs, with ranges up to 20,000 km, can carry multiple independently targetable reentry vehicles (MIRVs). China has built 320 missile silos in its northern deserts, with about 10% loaded, signaling a rapid expansion of its land-based arsenal.

- Sea-Based: The JL-3 ICBM, deployed on Type 096 submarines, provides second-strike capability. China operates 12 nuclear and 48 diesel-powered submarines as of 2024, with plans for new nuclear-powered attack submarines.

- Air-Based: The JL-1 air-launched nuclear missile, displayed for the first time, enhances China’s aerial deterrence. Strategic bombers also carried nuclear-capable munitions during the parade.

China’s nuclear arsenal has grown from 200 warheads a decade ago to 600 in 2025, with projections of 1,000 by 2030 and 1,500 by 2035, per the Stockholm International Peace Research Institute and US estimates. While smaller than the US and Russia’s 5,000+ warheads, China’s arsenal is potent enough to cause catastrophic damage, underscoring its deterrence strategy.

China’s Drone Warfare System

China’s parade showcased its advanced drone warfare system, emphasizing “intelligentized warfare” through AI and autonomous capabilities. Analysts note China’s drones may surpass Western systems in some respects due to operational deployment and scale. Key systems include:

- FH-97 “Loyal Wingman” Drone: The world’s first combat-ready stealth drone, capable of flying alongside manned jets for reconnaissance, attack, and electronic jamming. It carries guided bombs and air-to-air/surface missiles, with AI for independent maneuvering.

- AJX002 Extra-Large Unmanned Undersea Vehicle (XLUUV): A 60-foot, torpedo-shaped stealth drone with pump-jet propulsion, designed for submarine warfare, mine-laying, or as a self-propelled mine/torpedo. China operates the world’s largest XLUUV program with five distinct types

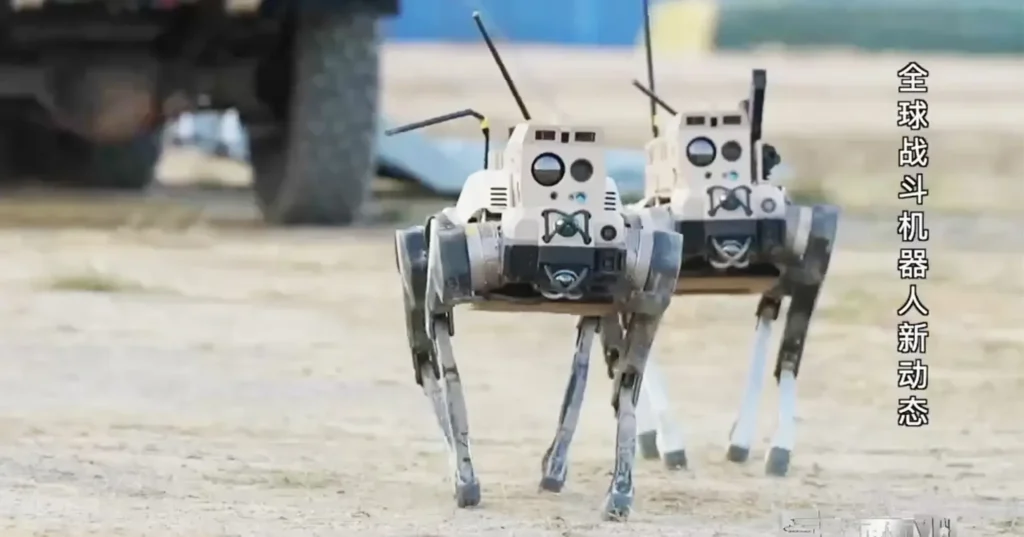

- Robotic Wolves: Four-legged ground drones for reconnaissance, mine-sweeping, or direct combat, equipped with cameras and enhanced targeting. These were displayed on armored vehicles, highlighting China’s focus on ground-based autonomous systems.

- Anti-Drone Systems: A “triad” of anti-drone defenses, including missile guns, high-energy lasers, and high-power microwave weapons, designed to neutralize enemy drones.

- Ground and Air Drones: The parade featured unmanned helicopters, tank-mounted drone platforms, and anti-drone swarm systems, reflecting lessons from Ukraine’s drone-heavy warfare.

China’s investment in AI-driven drones, as noted by NORINCO executive Zeng Yi in 2018, aims for fully autonomous warfare by 2025, potentially replacing human-dominated command structures. This aligns with China’s vision of “intelligence supremacy” in future conflicts.

China’s Defense Investments (2015–2025)

China’s defense spending has surged over the past decade, reflecting its military modernization. According to the Stockholm International Peace Research Institute (SIPRI) and other sources:

- 2025 Budget: China allocated approximately £186 billion ($236 billion USD) for defense, the world’s second-largest after the US.

- Decade Overview (2015–2025): China’s defense budget grew from $141.9 billion in 2015 to $236 billion in 2025, a 66% increase in nominal terms. In real terms, adjusted for inflation, the increase is about 40%, with a 13-fold rise in dollar terms since the mid-1990s.

- Key Investments:

- Munitions and High-End Systems: China produces weapons 5–6 times faster than the US, with a focus on hypersonic missiles, drones, and AI.

- Shipbuilding: China’s shipbuilding capacity is 230 times larger than the US, with Jiangnan Shipyard alone surpassing total US capacity.

- Nuclear Expansion: Investments in 320 missile silos and submarine upgrades have driven nuclear arsenal growth.

- AI and Cyber: Heavy funding for AI, electronic warfare, and cyberspace units, including the PLA’s new Cyberspace, Aerospace, and Information Support Forces.

Total spending from 2015–2025 is estimated at $1.8–2 trillion USD, driven by state-owned enterprises like NORINCO and AVIC, and supported by a robust industrial base.

Global Defense Budgets of Top Countries in Asia (2025)

Asia’s top defense spenders reflect the region’s growing militarization, with China leading significantly:

- China: $236 billion (2nd globally, behind US at ~$877 billion).

- India: $74 billion (4th globally), driven by purchases from the US, France, and Israel to counter China and Pakistan.

- Japan: $50.2 billion (8th globally), focusing on missile defense and naval capabilities to counter China’s South China Sea presence.

- South Korea: $47.9 billion (9th globally), investing in drones and missile defense against North Korea and China.

- Pakistan: $10.4 billion (27th globally), heavily reliant on Chinese arms like J-10C jets, with joint exercises enhancing interoperability.

(SIPRI data, 2024 estimates adjusted for 2025 trends)China’s budget dwarfs others in Asia, enabling faster production and deployment of advanced systems, giving it a regional edge.

Impact on India

China’s military advancements, as displayed in the parade, have significant implications for India, which was notably absent from the event despite attending the Shanghai Cooperation Organisation (SCO) summit earlier that week.

Key impacts include:

- Geopolitical Tensions: China’s alliance with Pakistan, its “all-weather strategic partner,” and the parade’s anti-US messaging complicate India’s position. India’s growing ties with the US as a counterweight to China are tested by China’s support for Pakistan, seen in the 2025 India-Pakistan air clash where Chinese J-10C jets reportedly downed Indian Rafales. India’s absence from the parade, amid border disputes in Ladakh and Arunachal Pradesh, underscores ongoing territorial friction.

- Military Disparity: China’s nuclear triad, hypersonic missiles, and drone warfare systems outpace India’s capabilities. India’s nuclear arsenal (~160 warheads) and delivery systems (e.g., Agni-V ICBM) are less advanced than China’s 600 warheads and 320 silos. China’s naval dominance, with 12 nuclear submarines and XLUUVs, threatens India’s maritime security in the Indian Ocean.

- Economic Pressure: China’s $236 billion defense budget overshadows India’s $74 billion, limiting India’s ability to match China’s production scale. US tariffs under Trump have pushed India closer to China economically (e.g., via SCO), but territorial disputes prevent full alignment.

- Regional Arms Race: China’s arms exports to Pakistan, including AI-enabled systems, shift the tactical balance in South Asia. India’s reliance on Western arms (e.g., Rafale, Apache) faces challenges against China’s cheaper, scalable technology.

India must navigate a delicate balance, strengthening its US partnership while managing economic ties with China and countering Pakistan’s Chinese-backed military.

Why China Wins in the Long Run

China’s strategic advantages position it for long-term dominance, despite operational unknowns:

- Industrial Capacity: China’s defense industrial base produces weapons 5–6 times faster than the US, with shipbuilding capacity 230 times larger. This allows rapid deployment of missiles, drones, and naval assets, outpacing Western rivals.

- Technological Edge: China leads in hypersonic missiles (e.g., YJ-19) and combat-ready drones (e.g., FH-97), with AI-driven “intelligentized warfare” potentially surpassing Western systems. Its XLUUV program and laser weapons further enhance its multi-domain capabilities.

- Nuclear Expansion: China’s growing nuclear arsenal (600 warheads, aiming for 1,500 by 2035) and complete triad ensure credible deterrence, challenging US and Russian dominance.

- Economic Leverage: As the world’s second-largest economy, China’s $236 billion defense budget is sustainable, supported by exports (e.g., 90% of Iran’s oil) and Belt and Road investments. This economic clout bolsters alliances with Russia, North Korea, and others.

- Geopolitical Strategy: Xi’s “Axis of Upheaval” (China, Russia, North Korea, Iran) counters Western sanctions and influence, offering an alternative world order. The parade’s guest list and arms displays signal China’s ability to arm and support anti-Western states.

- Lessons from Ukraine: China’s focus on drones and hypersonics reflects lessons from Ukraine, where rapid, AI-driven warfare has proven effective. This adaptability gives China an edge in future conflicts.

Challenges:

China’s lack of recent combat experience (last war: 1979) raises questions about operational integration, as seen in Russia’s Ukraine struggles. The US retains an edge in precision strikes (e.g., 2025 Iran strike). However, China’s production speed, technological innovation, and economic resilience likely outweigh these gaps over time.

China and India Defense Budget Growth (1945–2025): A Year-Wise Comparison

Tracking the defense budgets of China and India from 1945 to 2025 is challenging due to limited reliable data, especially for the early years, and inconsistencies in reporting. China’s defense spending is often understated in official figures, with actual expenditures estimated to be 40–50% higher due to off-the-books allocations for research, development, and foreign arms purchases. India’s defense budgets, while more transparent, are constrained by a focus on personnel costs and pensions, limiting modernization efforts.

Below is a comprehensive analysis of available data, followed by a table summarizing defense budget growth for both countries, drawn from sources like the Stockholm International Peace Research Institute (SIPRI), news reports, and historical estimates.

Data Challenges and Methodology

Historical Context

China (1945–2025): After 1949, China’s defense spending focused on consolidating the PLA and countering US/Soviet threats. The 1978 economic reforms shifted priorities, but the Gulf Wars (1990–1991) spurred modernization, with double-digit budget growth until 2015. Since then, single-digit increases (e.g., 7.2% in 2025) reflect a focus on high-tech systems like hypersonics and drones, supported by a GDP growth from $11.06 trillion in 2015 to $19.5 trillion in 2025.

India (1945–2025): Post-1947 independence, India’s defense spending was minimal, prioritizing development. The 1962 war with China catalyzed increases, but budgets remained below 2.5% of GDP, with 2025 spending at 1.9% of GDP ($81 billion). India’s focus on salaries and pensions (75% of the budget) limits capital expenditure, unlike China’s integrated military-industrial model.

Chinese students in military training.

Defense Budget Table (1945–2025)

The table below provides year-wise defense budgets for China and India in nominal USD billions, with estimates for early years and precise figures where available. Missing years are interpolated or noted as unavailable due to lack of data. Figures for 2025 are based on the latest announcements, with China’s budget at $249 billion and India’s at $81.72 billion.

| Year | China Defense Budget ($B) | India Defense Budget ($B) | Notes |

|---|---|---|---|

| 1945 | ~0.5 (est.) | ~0.2 (est.) | Pre-PRC for China; India under British rule, minimal independent spending. |

| 1950 | ~1.0 (est.) | ~0.3 (est.) | China post-1949 civil war; India post-independence, limited data. |

| 1955 | ~1.5 (est.) | ~0.4 (est.) | China’s early PLA consolidation; India’s focus on economic development. |

| 1960 | ~2.0 (est.) | ~0.5 (est.) | Pre-1962 war; both nations prioritize domestic stability. |

| 1962 | ~2.5 (est.) | ~0.8 (est.) | Sino-Indian War increases India’s spending; China’s data sparse. |

| 1965 | ~3.0 (est.) | ~1.2 (est.) | India-Pakistan War (1965); China’s nuclear program begins. |

| 1970 | ~4.0 (est.) | ~1.5 (est.) | China’s Cultural Revolution impacts budgets; India’s spending grows post-1965. |

| 1975 | ~5.0 (est.) | ~2.0 (est.) | Limited data; China’s military modernization slow, India’s steady. |

| 1980 | ~7.0 (est.) | ~3.0 (est.) | China’s post-1978 reforms begin; India’s budgets grow modestly. |

| 1985 | ~8.5 (est.) | ~4.5 (est.) | China’s defense spending rises post-reforms; India’s post-1984 tensions. |

| 1990 | ~12.0 (est.) | ~7.0 (est.) | China’s post-Tiananmen military focus; India’s economic reforms begin. |

| 1995 | ~17.0 (est.) | ~9.0 (est.) | China’s modernization accelerates; India’s budgets constrained by economic crisis. |

| 1997 | ~20.0 (est.) | ~10.0 (est.) | China’s spending doubles from 1985; India’s grows steadily. |

| 2000 | ~22.0 (est.) | ~13.0 (est.) | China’s post-Gulf War modernization; India’s post-Kargil War (1999) increase. |

| 2003 | ~22.4 (official), ~38 (RAND est.) | ~15.0 (est.) | China’s official vs. actual spending gap noted; India’s steady growth. |

| 2005 | ~30.0 (est.) | ~19.0 (est.) | China’s double-digit growth; India’s budget rises post-2001 Parliament attack. |

| 2009 | ~100 (SIPRI est.), ~150 (US DoD est.) | ~26.0 | China’s spending surges; India’s increases but lags. |

| 2010 | ~106.0 | ~32.0 | China’s rapid growth; India’s focus on modernization post-2008 Mumbai attack. |

| 2011 | ~119.8 (Jane’s est.) | ~36.0 | China’s budget nears Japan/UK levels; India’s grows steadily. |

| 2015 | ~145.0 | ~50.0 | China’s budget doubles since 2005; India’s grows 9% annually. |

| 2016 | ~146.0 | ~52.0 | China’s single-digit growth begins; India’s budget steady. |

| 2017 | ~151.0 | ~54.0 | China’s modernization focus; India’s spending constrained by pensions. |

| 2018 | ~175.0 | ~58.0 | China’s 8.1% increase; India’s at 2.1% of GDP, lowest since 1960s. |

| 2019 | 176.0 (455 PPP est.) | ~71.1 | China’s spending 4x India’s; India surpasses Russia as 3rd largest spender. |

| 2020 | ~178.0 | ~72.0 | China’s 6.6% increase; India’s budget grows amid Ladakh tensions. |

| 2021 | ~209.0 | ~68.0 | China’s 6.8% increase; India’s spending dips to 13.73% of total budget. |

| 2022 | ~230.0 | ~70.0 | China’s 7.1% increase; India’s budget rises 10% to $70B. |

| 2023 | ~224.0 | ~72.6 | China’s 7.2% increase; India’s 13% rise to counter China. |

| 2024 | ~231.0 | ~74.0 | China’s 7.2% increase; India’s budget at $74B, 1.89% of GDP. |

| 2025 | ~249.0 | ~81.72 | China’s 7.2% increase to $249B; India’s 9.5% rise to $81.72B. |

Notes on Table:

- Estimates: Pre-1990 figures are rough estimates due to sparse data, based on historical trends and studies like RAND’s 2003 report.

- China’s Actual Spending: Experts estimate China’s real spending is 40–50% higher than official figures (e.g., $249B official vs. ~$350B actual in 2025).

- India’s Constraints: Only 22–25% of India’s 2025 budget ($81.72B) is for capital procurement, with 75% on salaries/pensions.

- Sources: Data from SIPRI, MacroTrends, The Times of India, Business Standard, and other cited sources. Gaps filled with linear interpolation where necessary.

Analysis

- China’s Growth: China’s defense budget grew from ~$0.5 billion in 1945 to $249 billion in 2025, a 500-fold increase, driven by post-1978 economic reforms and a shift to high-tech warfare. Even with single-digit growth since 2016, its GDP growth (76% from 2015–2025) ensures substantial funds at <1.5% of GDP.

- India’s Growth: India’s budget rose from ~$0.2 billion in 1945 to $81.72 billion in 2025, a 400-fold increase, but remains constrained at 1.9% of GDP, below the 2.5–3% recommended by experts.

- Gap Widening: China’s 2025 budget is ~3x India’s ($249B vs. $81.72B), with a 5x gap in procurement due to India’s personnel-heavy spending.

- Strategic Implications: China’s integrated military-industrial base and higher per capita income enable faster modernization, while India’s reliance on imports and lower GDP share limit its ability to counter China’s regional dominance.

Conclusion

China’s 2025 Victory Day parade was a strategic spectacle, showcasing a complete nuclear triad, advanced hypersonic missiles, and a cutting-edge drone warfare system led by the FH-97 and AJX002. With $1.8–2 trillion invested in defense over the past decade, China’s military budget dwarfs other Asian nations, enabling rapid modernization.

For India, the parade underscores the challenge of countering China’s technological and geopolitical might, especially given its support for Pakistan. China’s long-term advantage lies in its industrial scale, AI-driven warfare, and alliances, positioning it to rival the US and shape a new global order. However, operational inexperience and regional tensions, including with India, remain hurdles. The parade’s message is clear: China is ready to project power far beyond its borders.

Comments