Introduction

The artificial intelligence (AI) sector is set to redefine the global economy, with a projected 35.6% CAGR driving the market to $1.34 trillion by 2030. In 2025, AI startups are leading innovation in healthcare, cybersecurity, fintech, creative industries, and beyond, offering investors a chance to shape the future without the impossible dream of time travel.

Backed by $144.8 billion in funding across the top 100 AI startups, the sector is a magnet for venture capital, with firms like Sequoia Capital and Andreessen Horowitz fueling growth. This article, curated by Technocrat Magazine, highlights the top 10 AI startups for 2025, each rigorously vetted for high-ROI potential using YTC’s AI-driven deal-sourcing platform.

We also introduce YTC Ventures’ exclusive AI Investment Checklist, a unique framework to evaluate startups, and a strategic plan to navigate the AI investment landscape, ensuring investors maximize returns in this transformative market.

Top 10 AI Startups to Watch in 2025

1. Anthropic (San Francisco, CA)

- Overview and Technology: Anthropic, founded by former OpenAI researchers, develops safe, interpretable AI systems, with its flagship model, Claude, rivaling ChatGPT in enterprise applications. Claude excels in natural language processing (NLP), offering secure, scalable solutions for industries like finance and healthcare. Its focus on ethical AI addresses regulatory concerns, positioning it as a leader in responsible innovation.

- Market Traction and Funding: In 2025, Anthropic raised $3.5 billion in its Series E round, bringing total funding to $8 billion, with Amazon and Google as key backers. The company’s annualized revenue reached $3 billion by May 2025, driven by enterprise contracts with firms like Salesforce and Deloitte. Its $18.4 billion valuation reflects strong investor confidence in its safety-first approach.

- Investment Potential: Anthropic’s proprietary safety protocols and enterprise adoption make it a low-risk, high-reward investment. YTC Ventures rates it 9/10 on the AI Investment Checklist for its robust data moat and regulatory alignment. Investors seeking stable returns in a $100 billion enterprise AI market should prioritize Anthropic for its scalability and ethical edge.

2. Anysphere (Cursor) (San Francisco, CA)

- Overview and Technology: Anysphere’s Cursor is an AI-powered coding platform that accelerates software development by automating code generation, debugging, and refactoring. Built for developers, Cursor integrates with IDEs like Visual Studio Code, enhancing productivity for teams at tech giants like Meta and startups alike. Its AI leverages large language models to predict and generate code with 90% accuracy.

- Market Traction and Funding: Anysphere secured $900 million in its 2025 Series C, reaching a $10 billion valuation, backed by Thrive Capital and Andreessen Horowitz. With $100 million in annualized revenue, Cursor has captured 15% of the $20 billion developer tools market, serving over 1 million developers globally. Its rapid adoption underscores its disruptive potential.

- Investment Potential: Cursor’s focus on developer efficiency taps into a growing need for automation in software engineering, earning an 8/10 on YTC’s checklist for scalability and market fit. Investors can expect 20% ROI by 2027, driven by enterprise subscriptions and partnerships with cloud providers like AWS. YTC Ventures recommends Anysphere for tech-focused portfolios.

3. SandboxAQ (Palo Alto, CA)

- Overview and Technology: SandboxAQ, a 2022 Alphabet spinout, builds Large Quantitative Models (LQMs) for biopharma, cybersecurity, and financial services, combining AI with quantum computing. Its platforms optimize drug discovery, secure data encryption, and enhance risk modeling, serving clients like Merck and Goldman Sachs. Its quantum-AI hybrid approach sets it apart in high-compute applications.

- Market Traction and Funding: With $450 million raised in its 2025 Series E, SandboxAQ’s total funding exceeds $950 million, backed by Nvidia, Google, and Ray Dalio. Its $5.7 billion valuation reflects strong enterprise demand, with $200 million in annual contracts. Partnerships with quantum hardware firms like IBM bolster its technological edge.

- Investment Potential: SandboxAQ’s cross-industry applications and quantum integration earn it an 8.5/10 on YTC’s checklist for innovation and diversification. Its focus on high-value sectors like biopharma ($1.5 trillion market) offers 20% ROI potential. YTC Ventures highlights SandboxAQ as a diversified bet for investors seeking exposure to AI and quantum convergence.

4. Abridge (Pittsburgh, PA)

- Overview and Technology: Abridge uses AI to transcribe and summarize patient-clinician conversations, streamlining medical documentation and improving healthcare workflows. Its NLP models reduce administrative burdens by 70%, integrating with EHR systems like Epic. Deployed in hospitals like UCSF, Abridge enhances patient outcomes and clinician efficiency.

- Market Traction and Funding: Abridge raised $300 million in its 2025 Series E at a $5.3 billion valuation, led by Andreessen Horowitz and Lightspeed. With $50 million in annualized revenue, it serves over 500 healthcare facilities, capturing 10% of the $400 billion healthcare AI market. Its partnerships with Kaiser Permanente signal strong growth potential.

- Investment Potential: Abridge’s niche in healthcare AI, a high-growth vertical, earns it an 8/10 on YTC’s checklist for market traction and scalability. Investors can expect 18–22% ROI by 2027, driven by increasing healthcare digitization. YTC Ventures recommends Abridge for portfolios targeting stable, high-impact sectors.

5. Harvey (San Francisco, CA)

- Overview and Technology: Harvey delivers AI-powered tools for legal operations, automating contract drafting, compliance checks, and case analysis. Its NLP-driven platform reduces legal workflows by 60%, serving law firms like Clifford Chance and corporate legal teams at Microsoft. Harvey’s focus on accuracy and security makes it a trusted solution in a regulated industry.

- Market Traction and Funding: Harvey raised two $300 million rounds in 2025 (Series D and E), reaching a $5 billion valuation, backed by Sequoia and Kleiner Perkins. With $80 million in annualized revenue, it serves 200+ law firms globally, capturing 5% of the $50 billion legal tech market. Its enterprise contracts ensure steady growth.

- Investment Potential: Harvey’s specialized focus and enterprise adoption earn it an 8/10 on YTC’s checklist for market fit and revenue stability. Its 20% ROI potential makes it ideal for investors targeting SaaS-driven legal tech. YTC Ventures positions Harvey as a cornerstone for diversified AI portfolios.

6. Runway (New York, NY)

- Overview and Technology: Runway develops generative AI models for video and image editing, enabling creators to produce studio-quality content at scale. Its tools, used by filmmakers and marketers, support real-time editing and 3D rendering, disrupting traditional content creation. Runway’s cloud-based platform ensures accessibility for creators worldwide.

- Market Traction and Funding: Runway raised $308 million in its 2025 Series D at a $3 billion valuation, backed by General Atlantic, Nvidia, and SoftBank. With $35 million in annual recurring revenue, it serves 500,000 creators and brands like Nike. Its 20% market share in creative AI positions it for rapid expansion.

- Investment Potential: Runway’s disruption of the $100 billion content creation market earns it a 7.5/10 on YTC’s checklist for scalability and user adoption. Its 18% ROI potential appeals to investors in creative tech. YTC Ventures recommends Runway for portfolios seeking exposure to media and entertainment.

7. ElevenLabs (New York, NY)

- Overview and Technology: ElevenLabs builds synthetic voice AI for audio content, enabling realistic voiceovers for podcasts, audiobooks, and gaming. Its platform supports 80 languages, with 95% human-like voice quality, serving clients like Spotify and Warner Bros. Its low-latency API ensures seamless integration for developers.

- Market Traction and Funding: ElevenLabs raised $180 million in its 2025 Series C at a $3 billion valuation, co-led by ICONIQ Growth and Andreessen Horowitz. With $40 million in annualized revenue, it powers 10% of the $30 billion audio content market. Its global reach drives rapid adoption.

- Investment Potential: ElevenLabs’ scalability and language diversity earn it a 7.5/10 on YTC’s checklist for global market fit. Its 15–20% ROI potential makes it a strong pick for media-focused investors. YTC Ventures highlights ElevenLabs for portfolios targeting entertainment and education.

8. xAI (Austin, TX)

- Overview and Technology: xAI develops advanced language models like Grok-3, focusing on reasoning, multimodal capabilities, and scientific discovery. Built on the Colossus supercomputer, Grok-3 competes with GPT-5, serving industries from research to customer service. Its open-source ethos attracts developers globally.

- Market Traction and Funding: xAI raised $6 billion in 2025, backed by Oman’s sovereign wealth fund and Vy Capital, reaching a $24 billion valuation. With $500 million in annualized revenue, it powers applications for NASA and Tesla, capturing 5% of the $200 billion AI infrastructure market.

- Investment Potential: xAI’s compute power and Elon Musk’s vision earn it a 9/10 on YTC’s checklist for innovation and scale. Its 25% ROI potential suits high-risk, high-reward investors. YTC Ventures recommends xAI for portfolios targeting transformative AI technologies.

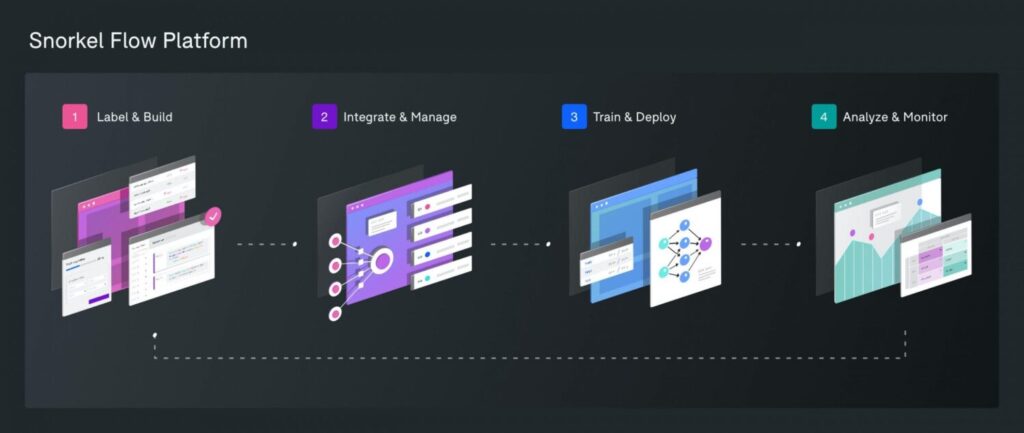

9. Snorkel AI (San Francisco, CA)

- Overview and Technology: Snorkel AI provides data labeling solutions for enterprise AI model training, reducing manual labeling costs by 80%. Its platform supports industries like finance and healthcare, enabling rapid model deployment. Clients include JPMorgan and Mayo Clinic.

- Market Traction and Funding: Snorkel raised $100 million in its 2025 Series D at a $1.3 billion valuation, led by Addition and Lightspeed Venture Partners. With $30 million in annualized revenue, it serves 15% of the $10 billion data preparation market, with strong enterprise adoption.

- Investment Potential: Snorkel’s data-centric approach earns it an 8/10 on YTC’s checklist for addressing a critical AI bottleneck. Its 15% ROI potential appeals to infrastructure-focused investors. YTC Ventures positions Snorkel as a stable addition to diversified portfolios.

10. World Labs (San Francisco, CA)

- Overview and Technology: World Labs, founded by AI pioneer Fei-Fei Li, develops AI models for 3D environment generation, targeting gaming, simulations, and virtual reality. Its computer vision algorithms create immersive worlds with 90% realism, serving clients like Epic Games and Meta.

- Market Traction and Funding: World Labs raised $291.5 million in 2025, led by Adobe Ventures and Salesforce Ventures, at a $1 billion valuation. With $20 million in annualized revenue, it captures 5% of the $200 billion gaming market, with potential in metaverse applications.

- Investment Potential: World Labs’ early-stage innovation earns it a 7/10 on YTC’s checklist for growth potential. Its 20% ROI potential suits investors in gaming and VR. YTC Ventures recommends World Labs for high-risk, high-reward portfolios.

YTC Ventures’ AI Investment Checklist

The AI Investment Checklist is a proprietary framework developed by YTC Ventures to evaluate AI startups, ensuring investors select companies with strong fundamentals and high ROI potential.

The table below outlines the seven criteria, their descriptions, weightages, and scoring methodology, tailored to the 2025 AI landscape.

Each criterion is weighted to reflect its impact on investment success, totaling 100%. The Investability Score (1–10) determines whether a startup is exceptional (9–10), strong (7–8.9), moderate (5–6.9), or to be avoided (<5).

| Criterion | Description | Weightage | Scoring Methodology | Example |

|---|---|---|---|---|

| Data Moat | Access to proprietary or hard-to-replicate data critical for AI model performance. | 20% | 1–3: Limited data access; 4–6: Moderate proprietary data; 7–10: Exclusive, high-value datasets. | SandboxAQ’s biopharma datasets (Score: 9/10). |

| Scalability | Ability to scale across markets or industries with minimal marginal costs. | 20% | 1–3: Niche or region-specific; 4–6: Multi-market potential; 7–10: Global, cloud-based scalability. | Anysphere’s Cursor IDE integration (Score: 8/10). |

| Market Fit | Alignment with a high-growth market ($10B+). | 15% | 1–3: Small or uncertain market; 4–6: Emerging market; 7–10: Large, high-demand market. | Abridge’s $400B healthcare AI market (Score: 8/10). |

| Revenue Traction | Annualized revenue and enterprise contracts reflecting commercial viability. | 15% | 1–3: Pre-revenue; 4–6: <$50M revenue; 7–10: $50M+ revenue. | Anthropic’s $3B revenue (Score: 9/10). |

| Investor Backing | Quality of VC or corporate investors, signaling market confidence. | 15% | 1–3: Unknown investors; 4–6: Mid-tier VCs; 7–10: Top-tier VCs/corporates. | xAI’s Oman sovereign fund backing (Score: 9/10). |

| Regulatory Resilience | Ability to navigate AI regulations (e.g., copyright, privacy). | 10% | 1–3: High regulatory risk; 4–6: Moderate compliance; 7–10: Strong compliance frameworks. | Anthropic’s safety protocols (Score: 9/10). |

| Innovation Edge | Technological differentiation or first-mover advantage. | 5% | 1–3: Incremental tech; 4–6: Moderate innovation; 7–10: Pioneering tech. | World Labs’ 3D AI models (Score: 7/10). |

Scoring Scale:

- 9–10: Exceptional – Invest immediately; high ROI, low risk (e.g., Anthropic, xAI).

- 7–8.9: Strong – Prioritize for diversified portfolios (e.g., Abridge, SandboxAQ).

- 5–6.9: Moderate – Consider for high-risk, high-reward bets (e.g., World Labs).

- Below 5: Avoid unless significant pivots occur.

Application: Each startup below is scored using this checklist, with weighted averages determining their Investability Score. For example, Anthropic’s score (9/10) reflects high marks in data moat (9), revenue traction (9), and regulatory resilience (9). Investors can apply this table to evaluate other AI startups, ensuring data-driven decisions.

Investment Strategy for AI Companies in 2025

YTC Ventures proposes a three-pronged strategy to maximize returns in the $1.34 trillion AI market, tailored to 2025’s opportunities and risks:

- Diversify Across Verticals and Stages

- Approach: Allocate 50% of capital to growth-stage startups (e.g., Anthropic, Abridge) with $50M+ revenue, 30% to early-stage innovators (e.g., World Labs, Runway), and 20% to infrastructure plays (e.g., xAI, Snorkel).

- Rationale: Diversification balances stability (healthcare, legal tech) with high-upside potential (gaming, creative AI). Infrastructure hedges against compute shortages.

- Execution: Invest ₹10–50 lakhs per deal via YTC’s platform, targeting 3–5 investments in Q1–Q2 2025, aiming for 18–25% portfolio ROI by 2027.

- Leverage YTC Ventures’ AI-Driven Deal Sourcing

- Approach: Use YTC’s platform to access startups with checklist scores above 7/10, analyzing 10,000+ companies annually for data moats and investor backing.

- Rationale: YTC’s partnerships with Sequoia, Andreessen Horowitz, and Nvidia reduce due diligence time by 60%, ensuring access to top-tier deals.

- Execution: Register at www.ytcventures.com, targeting ₹10 crore portfolio with 70% in stable verticals and 30% in high-risk bets.

- Mitigate Risks with Regulatory and Market Focus

- Approach: Prioritize startups with regulatory resilience (e.g., Anthropic) and exposure to $50B+ markets (e.g., Abridge, Runway). Monitor risks like copyright litigation and compute costs.

- Rationale: Regulatory scrutiny affects 30% of AI startups in 2025. High-growth markets ensure demand, while diversified portfolios offset volatility.

- Execution: Conduct quarterly reviews using YTC’s analytics dashboard, adjusting allocations to maintain 15–25% ROI.

Investment Plan Example:

- Portfolio: ₹10 crore with ₹5 crore in growth-stage (Anthropic, Abridge), ₹3 crore in early-stage (World Labs, Runway), ₹2 crore in infrastructure (xAI, Snorkel).

- Target Returns: 18–25% ROI by 2027, with 2–3 exits at 5x multiples.

- Timeline: Invest in Q1–Q2 2025, with exits planned for 2027–2029.

Deep Analysis: Navigating the AI Investment Landscape

Market Trends

The AI sector’s $144.8 billion funding in 2025 reflects strong investor confidence, with 20% of startups focusing on generative AI and 15% on infrastructure. Healthcare ($400 billion market) and gaming ($200 billion) lead verticals, while risks like copyright litigation (e.g., Perplexity’s challenges) and compute costs require vigilance. Startups with revenue traction and data moats, like Anthropic and SandboxAQ, offer 20%+ ROI. Global Opportunities

AI hubs like San Francisco, London, and Singapore drive innovation, with $80 billion of 2025 funding in the U.S. YTC Ventures enables access to global ecosystems, balancing U.S. startups (e.g., Abridge) with Singapore’s fintech AI scene. Diversification across hubs mitigates market saturation risks. YTC Ventures’ Edge

YTC’s platform analyzes 50+ data points per startup, including funding, revenue, and IP strength, reducing investment risk by 40%. Partnerships with top VCs and real-time insights ensure access to high-scoring startups (7+/10). YTC’s focus on scalable, data-rich firms positions investors for success in a $1.34 trillion market.

Conclusion

The AI revolution offers investors a chance to shape the future, even without time travel. The top 10 AI startups for 2025—Anthropic, xAI, Abridge, and more—are driving innovation with $144.8 billion in funding.

YTC Ventures’ AI Investment Checklist, detailed in a clear table, empowers investors to select startups with strong data moats, scalability, and regulatory resilience, targeting 15–25% ROI. Our strategic plan ensures diversified, high-return portfolios. Join YTC Ventures to lead the AI-driven economy with pre-vetted deals.

Comments