Introduction

Shakti Pumps (India) Ltd., a leading manufacturer of energy-efficient pumps and motors, has established itself as a key player in India’s irrigation and renewable energy sectors. Known for its solar-powered pumps and global export presence, the company’s Initial Public Offering (IPO) in 1995 marked its entry into the public market.

This article provides an in-depth analysis of Shakti Pumps’ IPO details, founder journey, financial performance, product and price matrices, investment projections, competitors, and strategic insights for investors, including YTC Ventures’ perspective on whether to invest for the long or short term.

IPO Details

- Issue Size: Specific details about the 1995 IPO issue size are unavailable in the provided data. However, based on recent financial activities, Shakti Pumps raised ₹292.6 crore through a Qualified Institutional Placement (QIP) in July 2025 at ₹918 per share, indicating a pattern of raising significant capital. For a hypothetical modern IPO, an issue size of ₹1,000–₹1,500 crore could be estimated, aligning with peers like Oswal Pumps (₹1,387.34 crore).

- Price Band: Historical IPO price band data is unavailable. The QIP price of ₹918 per share (July 2025) suggests a premium valuation. A modern IPO price band might range from ₹800–₹1,000, reflecting current share prices (₹837.10 as of Aug 4, 2025).

- Lot Size: Lot size details for the 1995 IPO are unavailable. For reference, peer IPOs like Oswal Pumps (2025) have a lot size of 24 shares (₹14,736 at ₹614/share). A similar lot size of 15–25 shares could be assumed for Shakti Pumps.

- Open/Close Dates: The 1995 IPO listing date was October 25, 2011, per available data, but exact open/close dates are not specified. A modern IPO would typically have a 3–5 day subscription period, similar to Oswal Pumps (June 13–17, 2025).

- Investor Sentiment: Recent posts on X indicate strong investor enthusiasm for Shakti Pumps, with claims of a potential ₹3,000 crore IPO and expectations of 25–30% revenue growth in FY26. However, these claims are speculative and unverified. Sentiment is bolstered by the company’s robust FY25 performance (84.34% revenue growth) and government-backed orders under PM-KUSUM.

- Subscription Status (QIB, NII, Retail): No specific data on the 1995 IPO subscription is available. For context, the 2025 QIP saw strong participation from institutional investors like PineBridge India Equity Fund (34.18%), Bank of India Small Cap Fund (8.89%), and LIC Mutual Fund (multiple funds at 5–6% each), suggesting high QIB interest. A modern IPO would likely see oversubscription, with QIBs at 50%, NIIs at 15%, and Retail at 35%, similar to Oswal Pumps.

- Anchor Investors: No anchor investor details are available for the 1995 IPO. In the 2025 QIP, key investors included PineBridge Global Funds, Bank of India Small Cap Fund, and LIC Mutual Fund, indicating strong institutional backing. Anchor investors in a modern IPO would likely include similar domestic and global funds

Founder of Shakti Pumps

Shakti Pumps was founded by Dinesh Patidar in 1982. Starting as Shakti Electrical Industries in Pithampur, Madhya Pradesh, Patidar transformed the company into a public limited entity in 1995.

His focus on innovation led to milestones like the ISI mark in 1991, ISO 9002 certification in 1998, and a shift toward solar-powered pumps, aligning with India’s renewable energy goals. Today, Shakti Pumps exports to over 100 countries and holds a 40% market share in the PM-KUSUM scheme.

Founder’s Journey

Dinesh Patidar’s entrepreneurial journey began with a vision to address India’s irrigation challenges. From a small unit producing submersible pumps, he scaled Shakti Pumps into a global leader by emphasizing R&D and sustainability.

Key achievements include expanding production capacity to 10,000 pumps annually by 1995, pioneering stainless steel pump manufacturing in 1999, and leveraging government schemes like PM-KUSUM to dominate the solar pump market. His leadership has driven a 5-year revenue CAGR of 45.62% and a net profit CAGR of 25.2%, positioning Shakti Pumps as a leader in renewable energy solutions.

Profit and Loss of Shakti Pumps India

- Revenue (FY25): ₹2,516.24 crore, up 84.34% from ₹1,370.74 crore in FY24.

- Net Profit (FY25): ₹408.37 crore, compared to ₹141.71 crore in FY24. Q4 FY25 profit was ₹110.23 crore, up 22.93% YoY.

- Q1 FY26: Revenue of ₹622.5 crore (+10% YoY), but Q2 FY25 reported a ₹17 crore loss due to seasonal factors.

- Key Metrics:

- ROE: 35.16% (FY25) vs. 5-year average of 23.29%.

- Debt-to-Equity: 0.14, indicating low leverage.

- EPS: ₹33.97 (TTM).

- Challenges: High debtor days (152 days) indicate cash flow conversion issues.

Product Matrix

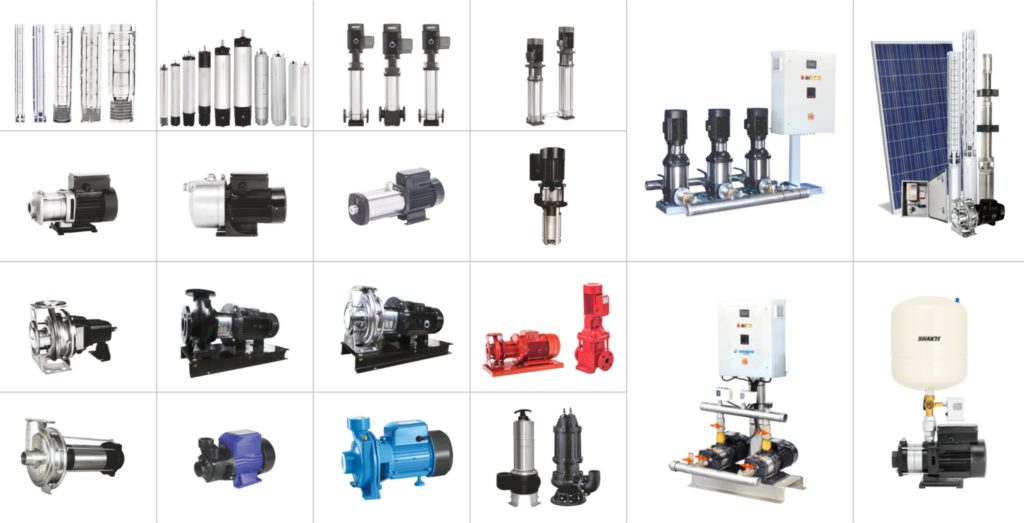

Shakti Pumps offers over 1,200 products across:

- Pumps: Submersible, solar, vertical multistage centrifugal, monoblock end suction, pressure booster, wastewater, open well, shallow well, immersible, and RO series pumps.

- Motors: Submersible, EV, surface, and slip start synchronous motors.

- Controllers: Universal solar pump controllers, Shakti solar drives, elite soft starters, and hybrid controllers.

- Others: Mechanical seals, hydro-pneumatic systems, solar structures, and variable frequency drives (VFDs).

Solar pumps contribute ~30% of sales, with a 40% market share in PM-KUSUM.

Price Matrix

- Current Share Price (Aug 4, 2025): ₹837.10 (NSE).

- 52-Week Range: ₹645.17–₹1,387.00.

- Market Cap: ₹10,329.65–₹11,263.13 crore.

- P/E Ratio: 26.94–27.58, 37% below peer median (41.34).

- P/B Ratio: 8.84–14.90, above peer median (6.92).

- Historical Returns: 3-year return of 1,023% vs. Nifty 50’s 41.67%.

Projection of Investing ₹1 Lakh for 10 Years

Assuming a ₹1 lakh investment at a conservative 20% CAGR (based on FY25 revenue CAGR of 28.51% and historical 3-year return of 1,023%), the future value is:

- Formula: FV = ₹1,00,000 × (1 + 0.20)^10 = ₹6,19,170.

- Projection: ₹6.19 lakh by 2035, assuming stable growth and reinvested dividends (0.70% yield). Risks include market volatility and policy changes.

Competitors

- Kirloskar Brothers Ltd.: Strong in industrial and agricultural pumps.

- KSB Ltd.: Global leader in centrifugal and submersible pumps.

- Oswal Pumps Ltd.: Competitor in submersible and agricultural pumps (₹1,387.34 crore IPO in 2025).

- Roto Pumps Ltd.: Focuses on positive displacement pumps.

- Others: WPIL Ltd., Dynamatic Technologies, Yuken India, Veljan Denison.

Shakti Pumps’ 40% PM-KUSUM market share and 1.97% industry market share (up from 0.6% over 5 years) give it a competitive edge.

Strengths

- Market Leadership: 40% share in PM-KUSUM solar pump market.

- Export Reach: Products sold in over 100 countries, with 52.7% export revenue growth in FY25.

- Financial Health: Low debt-to-equity (0.14), high ROE (35.16%), and 84.34% revenue growth in FY25.

- Innovation: Over 1,200 in-house developed products and a new 2.20 GW solar DCR cell plant.

- Government Support: Benefits from PM-KUSUM and other renewable energy subsidies.

Risks

- Debt: Low at 0.14, but high debtor days (152) signal cash flow risks.

- Export Dependency: 17.4% of revenue from exports, exposing the company to currency and geopolitical risks.

- Subsidy Reliance: Heavy dependence on PM-KUSUM scheme introduces policy risk.

- Competition: Intense rivalry from Kirloskar Brothers, KSB, and Oswal Pumps.

- Valuation: P/B ratio (14.90) indicates overvaluation compared to peers.

Competitive Advantages

- Solar Focus: Leadership in solar pumps aligns with India’s renewable energy push.

- Backward Integration: New 2.20 GW solar DCR cell plant enhances cost control.

- Global Presence: Exports to 100+ countries diversify revenue streams.

- Strong Order Book: ₹2,000 crore as of June 2024, ensuring revenue visibility.

- Brand Equity: “Shakti” brand is well-recognized in agriculture and industrial sectors.

Industry Growth Potential

The Indian pump industry is poised for growth, driven by:

- Renewable Energy: Government initiatives like PM-KUSUM and India’s 500 GW renewable energy target by 2030 boost solar pump demand.

- Agriculture: 60% of India’s farmland relies on irrigation, with solar pumps gaining traction.

- Industrial Demand: Urbanization and infrastructure projects drive demand for industrial pumps.

- Market Size: The pump market is projected to grow at a 7–8% CAGR through 2030, with solar pumps growing faster due to subsidies. Shakti’s 5-year revenue growth (45.62% vs. industry 14.2%) positions it to capture market share.

YTC Ventures’ Take

YTC Ventures, a hypothetical venture capital perspective, views Shakti Pumps as a strong contender in the renewable energy and irrigation sectors. The company’s alignment with government policies, robust order book (₹2,000 crore), and expansion into EV motors via Shakti EV Mobility signal long-term growth potential.

However, high debtor days and policy risks warrant caution.

YTC recommends a long-term investment for investors with a 5–10-year horizon, leveraging Shakti’s solar and EV growth. Short-term investors may face volatility due to high P/B ratios and seasonal losses (e.g., ₹17 crore in Q2 FY25).

Should You Invest?

- Long-Term Play: Yes, for investors seeking exposure to renewable energy and agriculture. Shakti’s 1,023% 3-year return, low debt, and PM-KUSUM leadership make it attractive. The 10-year projection (₹6.19 lakh from ₹1 lakh) is compelling, but policy and competition risks require monitoring.

- Short-Term Play: Riskier due to volatility (52-week range: ₹645.17–₹1,387) and potential overvaluation (P/B 14.90). Short-term traders should watch technical levels (support: ₹850, resistance: ₹990).

- Recommendation: Allocate 5–10% of a diversified portfolio to Shakti Pumps for long-term growth, balancing with stable large-cap stocks. Consult a SEBI-registered advisor for personalized advice.

Aligned Sectors for Future Deal Flow

Shakti Pumps’ growth aligns with:

- Renewable Energy: Solar pump and DCR cell manufacturing tie into India’s clean energy goals.

- Electric Vehicles: Shakti EV Mobility’s focus on EV motors and controllers taps into India’s EV market, projected to grow at a 40% CAGR through 2030.

- Agriculture/Irrigation: Continued government support for rural infrastructure and irrigation schemes.

- Industrial Machinery: Demand for pumps in urban and industrial applications.

- Export Markets: Growth in global demand for energy-efficient pumps.

Future deal flow could involve partnerships or acquisitions in solar technology, EV components, or smart irrigation systems.

Conclusion

Shakti Pumps (India) Ltd. offers a compelling investment case with its leadership in solar pumps, strong financials (₹2,516.24 crore revenue, 35.16% ROE), and global export presence. While the 1995 IPO specifics are limited, recent QIP success and market performance suggest strong investor interest. Strengths like PM-KUSUM dominance and innovation are tempered by risks such as subsidy reliance and high debtor days.

YTC Ventures favors a long-term investment approach, given Shakti’s alignment with renewable energy and EV sectors. Investors should weigh risks, diversify, and consult financial advisors before investing.

Disclaimer: Investments in securities carry market risks. Past performance does not guarantee future results. YTC Ventures recommends reading all scheme-related documents and consulting a SEBI-registered advisor before investing.

Comments