Abellon Clean Energy Ltd, once a high‑potential player in India’s waste‑to‑energy (WTE) sector, is now facing insolvency following loan defaults of over ₹15 crore and mounting losses. REC Ltd. filed a case under Section 7 of the IBC, though the National Company Law Tribunal (NCLT) dismissed the petition on July 23, 2025—granting REC the option to refile if no settlement is reached

Financial Breakdown & Institutional Withdrawal

Debt exposure to public sector lenders like REC, PFC, SBI Cap, and others stands at over ₹930 crore. Revenue plummeted: from ₹154 crore in 2020 to just ₹13 crore in 2023, with net losses of ₹19 crore in 2023 against prior profits of ₹11.1 crore in 2021

Institutional backers, notably the International Finance Corporation (IFC), withdrew a planned $40 million investment due to environmental and social concerns, responding to strong local protests and campaign pressure

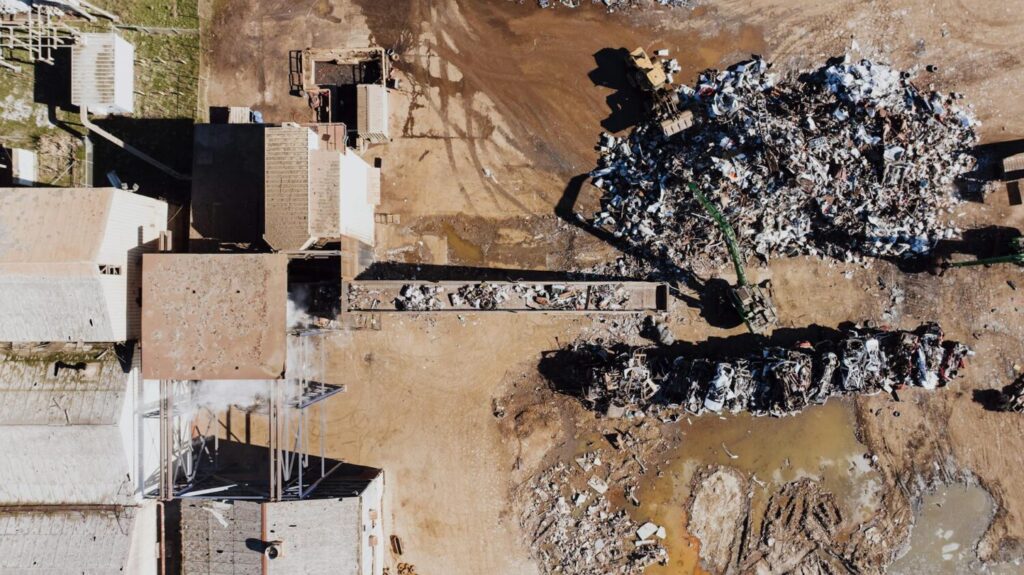

Environmental & Public Health Repercussions

The operational WTE plant in Jamnagar drew scrutiny from the Gujarat Pollution Control Board, which issued show-cause notices for regulatory non-compliance. Local residents reported respiratory illnesses, eye irritation, and other health impacts. Concerns were raised that Abellon intentionally remained under the 15 MW threshold to avoid mandatory environmental clearance .

Critics highlighted gaps in emissions monitoring, including untested ash disposal and absent data on toxic compounds like dioxins and furans .

Broader Implications: Policy, Finance & Waste Strategy in India

While Abellon’s collapse serves as a cautionary tale for WTE technology in India, it also raises urgent questions about public lending practices and the viability of incineration-based waste systems. Globally, many countries are phasing out WTE in favor of zero‑waste and decentralized recycling models; yet India’s large-scale projects continue receiving subsidies and bank support despite performance concerns .

At the same time, India’s Insolvency and Bankruptcy Code (IBC) is under pressure: creditor recoveries remain low and delays are routine. Only roughly one-third of admitted cases avoid liquidation, and many surpass prescribed timelines under IBC limits (extended from 270 to 330 days) .

Summary Table

| Aspect | Insight |

|---|---|

| Company | Abellon Clean Energy Ltd, WTE operator |

| Debt & Default | ₹15 Cr default; total exposure ~₹930 Cr |

| Revenue Trend | ₹154 Cr (2020) → ₹13 Cr (2023) |

| IFC Withdrawal | $40 M pulled amidst protests |

| Health/Environmental Issues | Pollution, non-compliance, local disease |

| IBC Context | Case dismissed but lenders still exposed |

| Sector Warning | Accelerating insolvency risks in WTE |

| Policy Signal | Need for due diligence and shift to zero waste |

Founder & Origin

Founded: Abellon Clean Energy Ltd (formerly Abellon Windenergy / Solarenergy) was incorporated on 9 July 2008 in Ahmedabad, Gujarat

Founder: The company was established around 2008–09 by Aditya Handa, a figure associated with social enterprise and clean-tech innovation

Leadership: It functioned under the Claris Group, with Arjun Handa serving as Chairman overseeing Abellon’s pivot into waste-to-energy and biofuel development

Capital & Financing Journey

Authorized Capital: Around ₹167.15 Cr; Paid-up Capital: ₹140.12 Cr as of July 2025

External Funding: Abellon sought significant project financing, including a proposed USD 40 million investment from IFC for its Gujarat WTE projects—ultimately withdrawn in early 2025 due to rising public resistance and environmental compliance concerns

Subsidies & Other Funding: Received government Viability Gap Funding, preferential power tariffs, plastic/carbon credit revenues, and ULB processing fees—all intended to sustain WTE operations financially—but still remained unprofitable.

Core Reasons Behind the Bankruptcy

- Operational Losses & Debt Burden:

- Net profit of US $1.28M in 2021 turned into a US $2.18M loss by 2023, with EBITDA shifting from positive $345K to negative –$1.84M. Debt servicing capacity worsened sharply—from 1.5× shortfall in 2022 to 14× by 2023

- Unviable Business Model Despite Subsidies:

- Even with government support, waste-to-energy (incineration) remained one of the costliest power generation methods (~₹7/unit), putting pressure on state budgets and highlighting unsustainable economics

- Environmental Non-Compliance & Community Backlash:

- The Jamnagar plant (operational since Nov 2021) triggered health complaints—respiratory issues, skin irritation, air pollution. Gujarat Pollution Control Board issued a show-cause notice by Dec 2021. Community activism played a key role in IFC withdrawing funding

- Weak Due Diligence and Evasion of Norms:

- Technical design kept project size deliberately below 15 MW (i.e. 14.9 MW) to bypass mandatory Environmental Clearance (EIA norms), while ESG assessments were downgraded to “Category B”, undermining credibility

- Sectoral Risks:

- A broader shift globally away from WTE incineration to zero-waste and decentralized recycling models, reflecting declining institutional backing for traditional WTE technologies

Lessons for Startups & Companies in WTE / Clean-Tech

| Lesson | Insight |

|---|---|

| 1. Financial Discipline Over Scale | Never rely solely on subsidies or uncertain funding. Profitability and manageable debt are critical. |

| 2. ESG & Social License Matter | Community consultation, honest impact studies, and full regulatory compliance prevent backlash and funding failures. |

| 3. Risk of Hidden Contingencies | Engineering “loopholes” (e.g. sub‑15 MW limit) may offer short‑term benefit but undermine long‑term viability. |

| 4. Tech Fit vs Market Reality | Not all clean-tech is suited for all regions—WTE incinerators face global pushback, especially when alternatives exist. |

| 5. Resilient Strategy Needed | Be agile—ready to pivot to recycling, bio-CNG, decentralized models as market/regulatory winds shift. |

| 6. Transparency Builds Credibility | Clear accounting, disclosures, and stakeholder engagement strengthen trust with funders and communities. |

| 7. Long-Term Vision ≠ Short-Term Hype | Over‑expansion without sustainable operational grounding invites collapse—start modestly and scale reliably. |

Summary Snapshot

- Founded: July 2008 by Aditya Handa; under Claris/Arjun Handa’s leadership

- Funding: ₹140 Cr equity capital; attempted $40M IFC debt; heavy dependence on government subsidies

- Downfall Drivers: Debt accumulation, sustained losses, community resistance, weak environmental compliance, flawed ESG

- Takeaway: Clean-tech companies must align technology, finance, governance, and community trust to succeed sustainably.

Takeaway

Abellon Clean Energy’s downfall underscores a critical intersection of financial mismanagement, flawed institutional support, and environmental neglect in India’s WTE narrative.

For lenders, policymakers, and clean-tech stakeholders, this case presents a compelling argument to reevaluate support for incineration-based infrastructure and redirect resources toward sustainable, community-driven waste solutions.

YTC Ventures

YTC Ventures is a Quantum Borderless Deal Flow Platform designed to connect visionary founders, asset holders, and institutions with the right global investment partners. We operate beyond borders, time zones, and legacy limitations—curating strategic B2B and B2C opportunities across industries, regions, and capital stages.

Whether you’re a startup seeking seed funding, a corporate scouting M&A targets, or a fund looking for high-potential deals—we activate precise matches using curated intelligence and Tridenta-backed frequency alignment.

Reach out to us to discover the right investment companies to fund your mission—anywhere on Earth or beyond. 🌍✨

📩 Contact: b2b@ytcventures.com

🔗 www.ytcventures.com/b2b-shop

Comments