On July 9, 2025, NVIDIA achieved a historic $4 trillion market capitalization, overtaking Apple and Microsoft to become the world’s most valuable publicly traded company. Fueled by the generative AI boom, NVIDIA’s dominance under CEO Jensen Huang has redefined the tech landscape. From its early GPU roots to leading AI, data centers, and autonomous vehicles, NVIDIA’s success offers lessons for investors and founders.

This YTC Ventures article explores why NVIDIA won the AI race, its business strategy, Huang’s spiritual leadership, the controversial Computex 2024 incident, company structure, vision, and how YTC Ventures identifies early-stage innovators poised for similar growth. Join www.ytcventures.com to discover the next tech titan.

NVIDIA achieved a historic $4 trillion market capitalization

Despite $5.5B losses from U.S.-China chip bans, NVIDIA’s stock rose 70% since April 2025, bolstered by partnerships like Trend Micro’s AI security solutions.

Why NVIDIA Won the AI Race

NVIDIA’s ascent to a $4 trillion valuation stems from strategic foresight and market dominance:

- Early AI Investment: In 2007, NVIDIA launched CUDA, enabling GPUs for AI computing. By 2012, investments in DGX systems positioned NVIDIA to capitalize on the 2022 ChatGPT-driven AI surge. Its H100 GPUs power 90% of cloud AI workloads.

- Market Leadership: NVIDIA holds an 80% share in discrete GPUs and dominates AI chip supply, with 2025 Blackwell chip orders sold out. FY 2025 revenue hit $130.5B, up 114% from FY 2024, driven by demand from OpenAI, Amazon, and Microsoft.

- Global Adaptability: Despite $5.5B losses from U.S.-China chip bans, NVIDIA’s stock rose 70% since April 2025, bolstered by partnerships like Trend Micro’s AI security solutions.

Investor Takeaway: NVIDIA’s early AI pivot is a model for spotting disruptive trends.

YTC Ventures identifies similar early-stage opportunities—sign up at www.ytcventures.com

NVIDIA’s Business Strategy

NVIDIA’s strategy blends innovation, diversification, and ecosystem-building:

- AI and Data Centers: The Compute and Networking segment, including AI chips, generated $116.1B in FY 2025, up 145%, surpassing the Graphics segment (13% of revenue).

- Diversified Markets: NVIDIA’s DRIVE platform powers autonomous vehicles for 370+ partners, while Omniverse supports 3D design, tapping $3T automotive and $1.3T AI markets.

- Strategic Alliances: Partnerships with Snowflake, Adobe, and Getty Images (e.g., Edify AI) integrate NVIDIA’s tech across industries.

- Startup Ecosystem: NVentures and Inception programs support 17,000+ startups, securing future markets.

Investor Opportunity: Fund startups leveraging NVIDIA’s platforms via YTC Ventures’ global network.

Join www.ytcventures.com to access high-growth AI ventures.

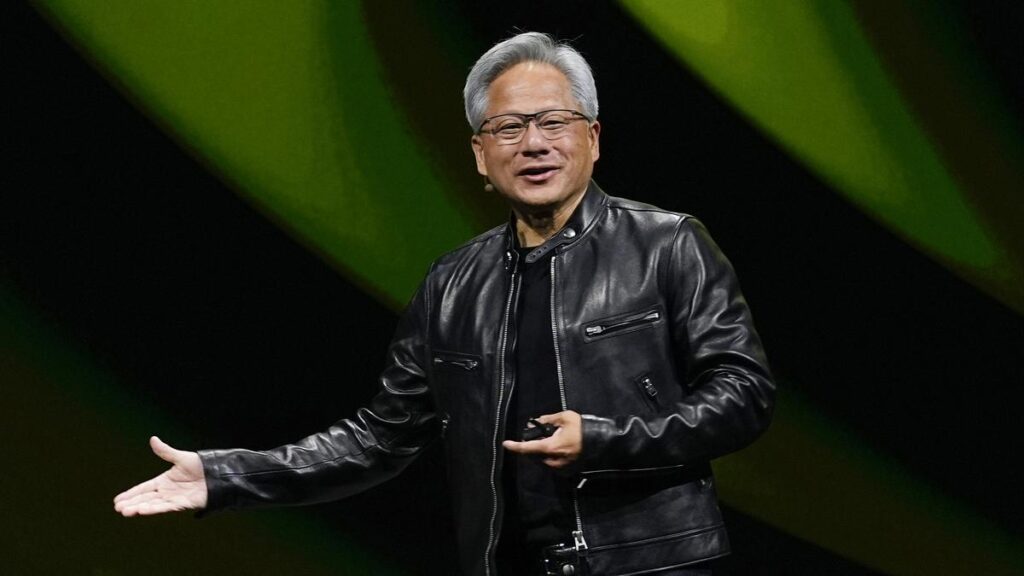

Jensen Huang’s Spiritual Management and Leadership Principles

Jensen Huang’s leadership combines technical vision with spiritual principles:

- Visionary Drive: Huang’s belief in AI’s “tipping point” has guided NVIDIA since 1993. His 3.45% stake (85M shares) aligns him with shareholders, with a $142B net worth (Forbes, June 2025).

- Flat Structure: Huang’s “learning machine” culture, with no rigid hierarchies, empowers 36,000 employees, earning a 79/100 Glassdoor score.

- Spiritual Approach: Huang’s mantra, “The mission is boss,” fosters humility and purpose. His resilience, from founding NVIDIA at a Denny’s to navigating near-bankruptcy, inspires innovation.

- Public Persona: Known for his Tom Ford leather jacket, Huang’s rockstar image was cemented at Computex 2024, where he signed a female fan’s chest, sparking global debate.

Founder Lesson: Huang’s vision and empathy are replicable. YTC Ventures mentors founders to adopt these traits—connect at www.ytcventures.com.

The Computex 2024 Controversy: Jensen Huang’s Chest-Signing Incident

At Computex 2024 in Taipei, Jensen Huang sparked a social media frenzy by signing a female fan’s tight-fitting top near her chest after she requested it. The incident, captured on video (Threads, @carnage4life), showed Huang hesitating, asking, “Is that a good idea?” before complying.

The fan later posted on Instagram, “Adrenaline rush today! I shook hands with the ‘AI Godfather’ and he signed my clothes. Hoping for great fortune!”

Reactions:

- Support: Some praised Huang’s approachable demeanor, with comments like, “He handled it calmly without overreacting” (X, @user). Others noted the signed top could fetch $500,000.

- Criticism: Critics called it “self-objectification” or “disrespectful,” arguing Huang should have declined due to ethical boundaries, especially as a married CEO (X, @user).

Impact: The incident amplified Huang’s rockstar status, with media comparing him to musicians, not typical CEOs like Tim Cook. It highlighted his unique public image but raised questions about professionalism in tech.

Investor Insight: Huang’s polarizing persona underscores the need for startups to balance bold branding with ethical leadership. YTC Ventures guides founders on this—join www.ytcventures.com.

NVIDIA’s Company Structure and Total Employees

- Workforce: NVIDIA employs 36,000 globally (FY 2025), with a per-employee market value of ~$100M, the highest among trillion-dollar firms.

- Leadership:

- Jensen Huang: President and CEO, driving AI vision.

- Colette Kress: EVP and CFO, managing $81.4B operating income.

- Tim Teter: EVP and General Counsel.

- Jay Puri: EVP of Worldwide Field Operations.

- Structure: As a fabless semiconductor firm, NVIDIA designs GPUs and outsources manufacturing to TSMC. Its flat structure fosters agility across AI, gaming, and automotive divisions.

- Global Presence: Offices in 125+ countries and 8,500+ patents ensure broad influence.

Investor Takeaway:

NVIDIA’s lean structure is a model for startups.

YTC Ventures identifies similar agile firms—sign up at www.ytcventures.com.

NVIDIA’s Vision

NVIDIA’s mission is “to transform computing.” Its vision includes:

- AI Leadership: Powering generative AI, autonomous vehicles, and the metaverse with Blackwell and DRIVE platforms.

- Sustainability: Reducing data center energy use (1-2% of global electricity) with efficient chips.

- Innovation Ecosystem: Supporting 17,000+ startups via NVentures and Inception.

Founder Opportunity: NVIDIA’s vision inspires scalable innovation. YTC Ventures connects founders to resources—join www.ytcventures.com.

Learning from NVIDIA for the World

NVIDIA’s lessons include:

- Trend Anticipation: Huang’s AI focus shows the power of early bets on emerging tech.

- Ecosystem Building: Partnerships and startup investments drive growth.

- Agile Culture: A flat structure accelerates innovation.

- Ethical Leadership: The Computex incident underscores balancing charisma with professionalism.

Global Impact: YTC Ventures applies these lessons to spot early-stage companies with NVIDIA-like potential.

Explore at www.ytcventures.com.

YTC Ventures: Your Portal to the Next NVIDIA

YTC Ventures is a global platform connecting investors and founders to early-stage tech innovators. Inspired by NVIDIA:

- Curated Investments: Identifies AI, robotics, and semiconductor startups with high-growth potential.

- Global Network: Partners with 20,000+ companies, mirroring NVIDIA’s ecosystem.

- Mentorship: Guides founders on vision, culture, and ethics, drawing from Huang’s principles.

- Access: Empowers investors to fund the next $4T company.

Call to Action: Investors and founders, join YTC Ventures at www.ytcventures.com to discover and build transformative tech.

Subscribe for exclusive insights!

Conclusion

NVIDIA’s $4 trillion milestone in July 2025, driven by Jensen Huang’s AI vision and bold leadership, redefines tech success. Despite controversies like the Computex 2024 chest-signing incident, NVIDIA’s strategy, culture, and ecosystem offer lessons for global innovation. YTC Ventures empowers investors and founders to back the next NVIDIA. Join www.ytcventures.com to shape the future of tech!Unlock the next tech revolution with YTC Ventures Technocrat Magazine. Subscribe at www.ytcventures.com for exclusive insights!

Comments