Discover how Jane Street, a secretive US trading firm, allegedly manipulated India’s derivatives market, earning ₹43,289 crore in profits. Learn about its founding, global revenues, leadership, staff, and revenue streams in this in-depth analysis.

Jane Street’s Rise and Controversy in India

Jane Street, a New York-based proprietary trading firm, has emerged as a powerhouse in global financial markets, leveraging cutting-edge technology and algorithmic strategies. In India, the firm has drawn intense scrutiny from the Securities and Exchange Board of India (SEBI) for allegedly manipulating the derivatives market, particularly in Nifty 50 and Bank Nifty indices. With reported profits of ₹43,289 crore (approximately $5 billion) in India alone between January 2023 and March 2025, Jane Street’s operations have sparked debates about fairness in the Indian stock market.

This article explores how Jane Street allegedly “fooled” other institutions, its staggering profits, founding history, leadership structure, staff, and diverse revenue streams, with a focus on its impact in India.

How Jane Street Allegedly Manipulated India’s Markets

SEBI’s investigation into Jane Street’s trading activities has revealed a sophisticated strategy that allegedly manipulated India’s booming derivatives market. According to SEBI, Jane Street’s entities—Jane Street Asia Trading Limited (JSATL), Jane Street India Trading Private Limited (JSITPL), and Jane Street Asia LLC (JSALLC)—executed coordinated trades to influence benchmark indices like Nifty 50 and Bank Nifty.

Here’s how they allegedly operated:

- Paired Trades for Price Manipulation: Jane Street entities reportedly took opposite positions in index derivatives, with one entity buying and another selling the same contract simultaneously at the same price. These trades, often reversed within seconds, were designed to shift or stabilize index prices without external market exposure. SEBI noted that these were not hedging strategies but deliberate attempts to manipulate closing prices, particularly during monthly and weekly expiry sessions.

- Exploiting Expiry Sessions: Jane Street allegedly placed large orders in the final minutes of trading to influence the closing price of indices. Since index derivatives settle based on closing prices, even small price movements could yield massive profits. SEBI described this as a “deliberate strategy to manipulate indices” for the firm’s options positions.

- Sacrificing Losses for Bigger Gains: SEBI found that Jane Street incurred deliberate losses of ₹7,208 crore in cash equities, stock futures, and index futures to generate much larger profits of ₹43,289 crore in the options segment. This pattern suggests that losses were a calculated move to manipulate prices for outsized derivatives gains.

- Impact on Retail Investors: With retail investors making up 35% of India’s options trades and 90% losing money, Jane Street’s strategies allegedly exploited less sophisticated market participants. Critics argue that the firm’s high-frequency trading (HFT) and algorithmic approaches created an uneven playing field, prompting SEBI to impose restrictions like higher investment limits and larger lot sizes to protect retail traders.

Reported profits of ₹43,289 crore (approximately $5 billion) in India

Jane Street was founded in 2000 by Tim Reynolds, Rob Granieri, Marc Gerstein, and Michael Jenkins, with Drew Krichman also noted as a co-founder in some sources.

SEBI’s response was swift: a complete ban on Jane Street’s access to Indian securities markets, a freeze of ₹4,844 crore ($566.3 million) in alleged illegal gains, and orders to close all open positions within three months.

This marks one of SEBI’s most aggressive actions against a foreign trading firm, highlighting concerns about algorithmic trading’s impact on India’s markets

Jane Street’s Profits in India and Globally

Jane Street’s financial success is staggering, both in India and worldwide, driven by its expertise in high-frequency trading and market-making.Profits in India

- 2023: Jane Street earned $1 billion (₹8,300 crore) from trading options in India, as revealed during a U.S. court case against Millennium Management. This profit stemmed from a “secret” trading strategy focused on India’s options market.

- 2024: The firm’s net revenue from equity derivatives in India surged to $2.3 billion (₹19,090 crore), accounting

Jane Street’s Founding and Evolution

Jane Street was founded in 2000 by Tim Reynolds, Rob Granieri, Marc Gerstein, and Michael Jenkins, with Drew Krichman also noted as a co-founder in some sources. The founders, several of whom were former traders at Susquehanna International Group, established Jane Street as a proprietary trading firm focused on leveraging advanced quantitative analysis and technology.

Initially a small operation, the firm has grown into a global leader in high-frequency trading (HFT) and market-making, trading over $17 trillion in securities in 2020 alone across more than 200 venues in 45 countries. Its early focus on exchange-traded funds (ETFs) and complex financial instruments has made it a dominant force, particularly in maintaining liquidity for bond ETFs during market turmoil, such as in 2020.

From its New York headquarters, Jane Street expanded to six offices worldwide, including London, Hong Kong, Amsterdam, Chicago, and Singapore. In India, the firm began operations in December 2020 through JSI Investments Private Ltd and operates via four entities, including two in Hong Kong and Singapore, registered as foreign portfolio investors (FPIs).

This strategic expansion underscores India’s growing importance to Jane Street’s global operations.

Global Profits and Financial Dominance

Jane Street’s global financial performance is remarkable, consistently outpacing major investment banks. For four consecutive years through 2023, the firm generated over $10 billion in net trading revenue annually. In 2023, its gross trading revenue reached $21.9 billion, equivalent to roughly one-seventh of the combined trading revenues of the world’s leading investment banks.

Adjusted earnings for 2023 were $7.4 billion, supported by a trading capital base of approximately $15 billion. In the first half of 2024, Jane Street’s trading revenues surged by 78%, signaling another strong year.

Globally, the firm holds about $50 billion in securities daily and is an authorized participant in 2,600 ETFs, acting as a lead market-maker for 506 ETFs.

In India, Jane Street’s profits from equity derivatives trading reached $2.3 billion in 2024, contributing over 10% of its record $20.5 billion global net trading revenue that year. Between January 2023 and March 2025, SEBI reported that Jane Street’s four entities collectively earned ₹43,289 crore ($5 billion) in India’s equity options market, highlighting its aggressive expansion in the world’s largest derivatives market by contract volume.

Leadership Structure: No Traditional CEO

Unlike conventional firms, Jane Street operates without a formal CEO, adopting a “functionally-organized structure” led by various management and risk committees. Approximately 30-40 senior executives, including co-founder Rob Granieri, who is described as a “first among equals,” guide major decisions collaboratively.

This structure fosters a flat hierarchy and emphasizes collective decision-making, with compensation tied to the firm’s overall profits rather than individual trading performance. This unique approach minimizes internal competition and aligns with Jane Street’s culture of collaborative problem-solving and risk management, including annual spending of $50-$75 million on put options to hedge against market crashes.

Staff and Workforce

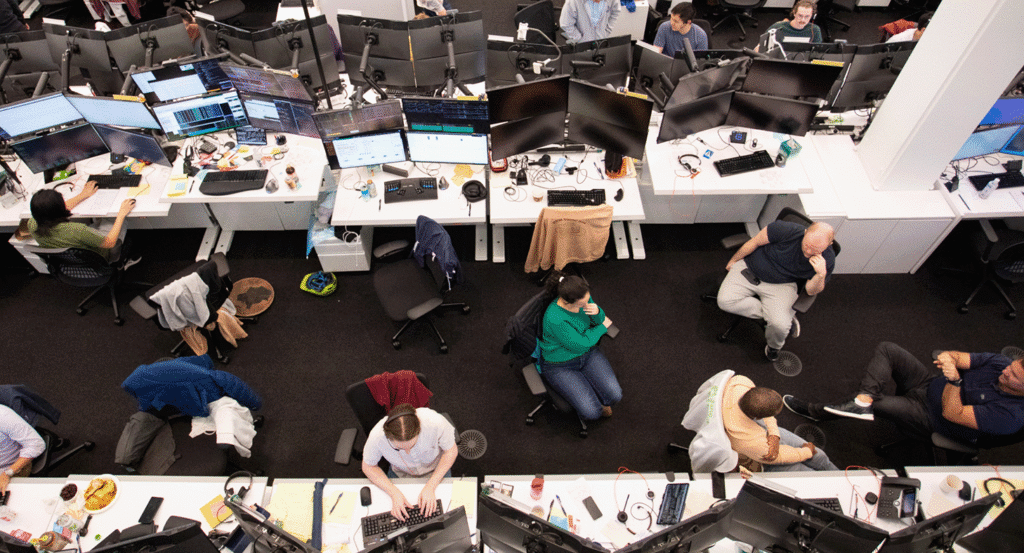

Jane Street employs over 3,000 professionals across its global offices, with more than 2,600 as of 2023, growing to over 3,000 by 2025. The firm hires researchers, traders, and technologists with deep mathematical fluency, emphasizing expertise in areas like distributed systems, security, and compilers. Its software, primarily written in the OCaml programming language, spans roughly 70 million lines of code, reflecting its tech-driven approach. Jane Street’s culture prioritizes understanding edge cases and tail risks, ensuring robust trading systems. In India, its operations are managed through entities like JSI Investments Private Ltd, though specific staffing details for India are limited.

The firm’s global workforce includes operational teams in legal, compliance, finance, tax, and HR to support its complex operations.

Revenue Streams

Jane Street’s revenue streams are diverse, driven by its proprietary trading and market-making activities across multiple asset classes:

- Exchange-Traded Funds (ETFs): Jane Street is a global leader in ETF liquidity provision, acting as an authorized participant for 2,600 ETFs and a lead market-maker for 506. Its ETF trading, particularly in bonds, generated significant profits during volatile markets like 2020.

- Equity Derivatives and Options: In India, Jane Street’s primary revenue comes from equity derivatives, especially options on Nifty 50 and Bank Nifty indices, yielding $2.3 billion in 2024 alone. Globally, options trading is a key profit driver.

- Equities and Bonds: In 2020, Jane Street traded $4 trillion in global equities and $1.4 trillion in bonds, leveraging its proprietary capital to maintain positions for hours to weeks, especially in less-liquid markets.

- High-Frequency Trading (HFT): Jane Street’s algorithmic, technology-driven HFT strategies provide a competitive edge, particularly in India’s options market, where rapid trades capitalize on market inefficiencies.

- Client Liquidity Services: The firm offers institutional clients direct access to liquidity across equities, fixed income, and commodity ETFs, focusing on emerging markets.

These streams, powered by sophisticated quantitative analysis and proprietary algorithms, have positioned Jane Street as a top-tier player, outearning competitors like Citadel Securities in certain years.

Controversies and Regulatory Scrutiny

Beyond India, Jane Street faced controversy in the U.S., suing Millennium Management in April 2024 for allegedly stealing a proprietary trading strategy that earned $1 billion in India in 2023. The case, settled confidentially in December 2024, highlighted the competitive stakes in India’s options market. Additionally, co-founder Rob Granieri was linked to an alleged coup plot in South Sudan in June 2025, though he claimed he was misled.

These incidents, alongside SEBI’s probe, have dented Jane Street’s low-profile reputation.

Why Jane Street Matters for Indian Investors

Jane Street’s activities in India highlight the opportunities and risks in the derivatives market. For Indian investors and firms like YTC Ventures, understanding Jane Street’s strategies—while navigating SEBI’s tightened regulations—can inform approaches to algorithmic trading and market-making. The firm’s success underscores the potential of technology-driven trading but also the need for transparency and fairness to protect retail investors, who face significant losses in options trading

Conclusion

Jane Street’s meteoric rise from a niche trading firm to a global powerhouse reflects its mastery of technology and quantitative analysis. In India, its alleged manipulation of derivatives markets, generating ₹43,289 crore in profits, has triggered SEBI’s scrutiny and a market ban, raising questions about ethical trading practices. With no traditional CEO, a collaborative leadership model, over 3,000 employees, and diverse revenue streams from ETFs, options, and HFT, Jane Street continues to redefine trading. For Indian audiences, this saga is a wake-up call to strengthen regulatory frameworks and equip retail investors to compete in a tech-driven market.

Call to Action

Stay informed about India’s financial markets! Subscribe to YTC Ventures’ for expert insights on investment technology and market trends.

Comments